Recent Blog Posts

Examples of situations where taxpayers may lose their tax deduction for a theft loss

Taxpayers may lose their tax deduction for a theft loss if they have a reasonable prospect of recovering all or a portion of the loss. In such cases, the theft loss deduction will be postponed until there is a recovery or there is a certainty that the loss will not be recovered. For example,… Read More »

How to Leverage Clawbacks for Tax Relief After a Ponzi Scheme

United States tax attorney, Richard S. Lehman has created many educational videos to help educate the public on United States taxation. This fifty-minute educational video is about getting tax refunds when someone has made money in a Ponzi scheme and later the scheme collapses. When this happens, a bankruptcy trustee is appointed to collect… Read More »

Understanding Ponzi Scheme Clawbacks PLUS How To Maximize Your Tax Refunds

In this video, we’ll discuss a unique tax refund scenario related to Ponzi schemes. Imagine someone making money in a Ponzi scheme, and years later, when the scheme collapses, a trustee is appointed to recover funds from those who profited. The trustee is often successful in collecting back the money, including the profits and… Read More »

Lessons from Madoff’s Ponzi: 5 Crucial Messages for Investors

Bernie Madoff’s Massive Ponzi Scheme: Bernie Madoff, a prominent figure in the international tax field, orchestrated a fraudulent investment scheme that deceived hundreds, if not thousands, of investors. Madoff’s elaborate scam led people to believe they were earning substantial profits, but in reality, their money was being siphoned off, resulting in devastating losses. The… Read More »

The “Safe Harbor” needs to be studied carefully

It is important to remember that the IRS is not in business to give back money. The “Safe Harbor” (Rev. Proc. 2009-20) needs to be studied carefully, because it could be extremely expensive from a tax standpoint. It might be a safe harbor — but the tax cost to dock your boat in this… Read More »

Who Specializes In Cryptocurrency Tax Issues?

A United States Tax Attorney and a Cryptocurrency CPA may be the ideal team depending on your specific situation and needs. While there is some overlap in the services provided by tax attorneys and crypto CPAs, there are also some important differences. Tax attorneys can provide legal advice and represent clients in legal disputes,… Read More »

The two most critical mistakes that result in the loss of the maximum advantage of Ponzi tax deductions seem to be:

The failure to deduct tax losses in the correct year and entering into settlements that may result in a reduced value of the loss are the two most significant errors that can lead to the loss of maximum advantage of tax deductions. For instance, if a settlement includes shares of stock that subsequently lose… Read More »

Many may remember in 2008 the chaos at the I.R.S. about how to deal with the Madoff Ponzi

In 2008, the Internal Revenue Service was not ready to solve the Madoff disaster. However, they quickly did the best that they could and published two documents to at least help the victims of this scheme. The two documents provided some relief to injured parties. These two documents were sorely needed and well done…. Read More »

The Safe Harbor is very meaningful for direct Ponzi Scheme victims – like those involved with the FTX, SBF and Alameda Research fraud.

The Ponzi Scheme is a theft loss, and is tax deductible in the year the loss is discovered. It is important to note, recently (January 24, 2023) the IRS updated questions on common digital assets that include: Convertible virtual currency and cryptocurrency, Stablecoins, and Non-fungible tokens (NFTs). All taxpayers must answer Yes or No… Read More »

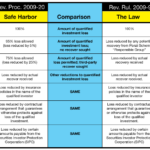

REPORT No. 3: The Safe Harbor

The Revenue Ruling 2009-9 and IRS Safe Harbor (Revenue Procedure 2009-20) In 2009, two important documents were issued by the IRS regarding the taxation of Ponzi schemes. In the Rev. Rul. 2009-9, the IRS clarified much of the previously unsettled law in this area. The Rev. Proc. 2009-20 applies to losses for which the… Read More »