Posts Tagged ‘richard lehman’

These new IRS modifications are very significant.

It is absolutely critical to understand these important IRS changes, please contact veteran tax attorney Richard S. Lehman Esq., today. The new Internal Revenue Service ruling greatly reduces offshore voluntary disclosure procedure for Americans with un-reported foreign bank accounts.

New IRS Announcement can be found here: http://www.irs.gov/Individuals/International-Taxpayers/Streamlined-Filing-Compliance-Procedures

U.S. Taxpayers Residing in the United States

- The following streamlined procedures are referred to as the Streamlined Domestic Offshore procedures and can be found here: http://www.irs.gov/Individuals/International-Taxpayers/U-S-Taxpayers-Residing-in-the-United-States

U.S. Taxpayers Residing Outside the United States

- The following streamlined procedures are referred to as the Streamlined Foreign Offshore Procedures and can be found here: http://www.irs.gov/Individuals/International-Taxpayers/U-S-Taxpayers-Residing-Outside-the-United-States

Updated Offshore Voluntary Disclosure Program Frequently Asked Questions

- The IRS’s Offshore Voluntary Disclosure Program Frequently Asked Questions and Answers can be found here: http://www.irs.gov/Individuals/International-Taxpayers/Offshore-Voluntary-Disclosure-Program-Frequently-Asked-Questions-and-Answers-2012-Revised

All IRS Tax Information For International Businesses can be found here: http://www.irs.gov/Businesses/International-Businesses

Be knowledgeable and know your legal rights.

The video below is 1-hour in length, and very informative.

Americans now required to disclose all foreign financial assets

by Richard S. Lehman

Background

A little known new law was enacted for the year 2011 that requires, that once certain minimum amounts are exceeded, any specified person that holds any interest in a specified foreign financial asset during the taxable year to attach a statement to that person’s U.S. tax return and report information that identifies the value of those specified foreign financial assets in which the individual holds an interest. Form 8938. 1/

Specified foreign financial assets include financial accounts maintained by foreign financial institutions, as well as certain other financial assets or instruments. An asset or instrument may be a specified foreign financial asset even if the asset or instrument does not have a positive value.

A specified foreign financial asset is (i) any financial account maintained by a foreign financial institution; (ii) any stock or security issued by any person other than a United States person; (iii) any financial instrument or contract held for investment that has an issuer or counterparty that is not a United States person; and (iv) any interest in a foreign entity.

A specified person is defined as a specified individual who is a U.S. citizen, a resident alien or a nonresident who elects to be taxed as a U.S. resident filing Form 1040; and U.S. entities required to file an annual tax returns such as a 1041 (Trust and Estate), 1120 (U.S. Corporation), 1120-S and 1065 (Partnership).

A specified person that is the owner of an entity disregarded as an entity separate from its owner is treated as having an interest in any specified foreign financial assets held by the disregarded entity. In addition, a specified person that is treated as the owner of a trust or estate or any portion of a trust under certain sections of the Internal Revenue Code is treated as if that person holds an interest in any specified foreign financial assets held by the trust or estate or by the portion of the trust or estate that the specified person owns.

Interest in a Specified Foreign Financial Asset

A specified person has an interest in a specified foreign financial asset if any income, gains, losses, deductions, credits, gross proceeds, or distributions attributable to the holding or disposition of the specified foreign financial asset are or would be required to be reported, included, or otherwise reflected by the specified person on an annual return. A specified person has an interest in a specified foreign financial asset even if no income, gains, losses, deductions, credits, gross proceeds, or distributions are attributable to the holding or disposition of the specified foreign financial asset for the taxable year.

A beneficial interest in a foreign trust or a foreign estate is not a specified foreign financial asset of a specified person unless the specified person knows or has reason to know of the interest based on readily accessible information of the interest. Receipt of a distribution from the foreign trust or foreign estate is deemed for this purpose to be actual knowledge of the interest.

The Minimum Reporting Requirements.

Unmarried Taxpayer Living in the United States.

Unmarried individuals living in the U.S. have a reporting threshold only if the total value of their specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year.

Married Taxpayers Filing a Joint Income Tax Return and Living in the United States.

Married persons filing a joint income tax return that do not live abroad, satisfy the reporting threshold only if the total value of their joint specified foreign financial assets are more than $100,000 on the last day of the tax year or more than $150,000 at any time during the tax year.

Married Taxpayers Filing Separate Income Tax Returns and living in the United States.

Married persons filing a separate income tax return from their spouse, living in the U.S. satisfy the reporting threshold only if the total value of each person’s specified foreign financial assets are more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year.

Taxpayers Living Abroad.

Taxpayers whose tax home is in a foreign country that meets a presence test in that foreign country, satisfy the reporting threshold if they are not filing a joint return if the total value of their specified foreign financial assets is more than $200,000 on the last day of the tax year or more than $300,000 at any time during the tax year.

Married and file a joint income tax return satisfy the reporting threshold only if the total value of all specified foreign financial asset the couple owns is more than $400,000 on the last day of the tax year or more than $600,000 at any time during the tax year.

Penalties

There are penalties for the failure to disclose the information required to be reported. If the failure to comply continues for more than 90 days after the day on which the failure is reported to the individual, the individual must pay an additional penalty of $10,000 for each 30-day period (or fraction thereof) during which the failure to disclose continues after the expiration of the 90-day period, to a maximum of $50,000.

However, no penalty will be imposed for any failure to report that is shown to be due to reasonable cause and not due to willful neglect. But one cannot excuse the failure to disclose assets just because disclosing the information required could lead to violations of foreign laws. There also can be criminal penalties for the failure to file the report.

Helpful Definitions

Financial Account maintained by a Foreign Financial Institution

A financial account is defined as respect to any financial institutions –

- Any depository account maintained by such financial institution;

- Any custodial account maintained by such financial institution; and

- Any equity or debt interest in such financial institutions (other than interests which are regularly traded on an established securities market).

Any equity or debt interest which constitutes a financial account with respect to any financial institution shall be treated for purposes of this section as maintained by such financial institution.

A Foreign Financial Institution

A foreign financial institution is a financial institution that is a foreign entity that:

- Accepts deposits in the ordinary course of a banking or similar business;

- Holds financial assets for the account of others as a substantial portion of its business; or

- Is engaged, or holds itself out as being engaged, primarily in the business of investing, reinvesting, or trading in securities, or any other financial interest such as forward contracts or options on securities, partnership interests, or commodities

An asset held in a financial account maintained by a foreign financial institution is not required to be reported separately from the reported financial account in which the asset is held. The value of an asset held in a financial account maintained by a foreign financial institution is included in determining the maximum value of that account.

Other Financial Assets

Examples of other specified foreign financial assets include the following, if they are held for investment and not held in a financial account.

- Stock issued by a foreign corporation.

- A capital or profits interest in a corporation.

- A note, bond, debenture, or other form of indebtedness issued by a foreign person.

- An interest in a foreign trust of foreign estate.

- An interest rate swap, currency swap, basis swap, interest rate cap, interest rate floor, commodity swap, equity swap, equity index swap, credit default swap, or similar agreement with a foreign counterparty.

- An option or other derivative instrument with respect to any of these examples or with respect to any currency or commodity that is entered into with a foreign counterparty or issuer.

An asset is held for investment if that asset is not used in, or held for use in, the conduct of a trade or business of a specified person. Personnel who are actively involved in the conduct of the trade or business exercise significant management and control over the investment of such asset.

There are also certain Exclusions for Assets Not Subject to Reporting

These include:

- (1) Assets such as those which specified persons, such as traders and others in the securities business use mark-to-market accounting method and

- (2) Interests in a social security, social insurance, or other similar program of a foreign government. However, this generally does not include similar programs that are funded by the Taxpayer’s voluntary payments such as I.R.A.’s,

- (3) Foreign assets used in a trade or business are not subject to the reportingrequirements. An asset is used in, or held for use in, the conduct of a trade or business and not held for investment if the asset is:

- (A) Held for the principal purpose of promoting the present conduct of a trade or business.

- (B) Acquired and held in the ordinary course of a trade or business, as, for example, in the case of an account or note receivable arising from that

- (C) trade or business; or

- (D) Otherwise held in a direct relationship to the trade or business.

In determining whether an asset is used in a trade or business, principal consideration will be given to whether the asset is needed in the trade or business of the specified person. An asset shall be considered needed in a trade or business, for this purpose, only if the asset is held to meet the present needs of that trade or business and not its anticipated future needs. An asset shall be considered as needed in the trade or business if, for example, the asset is held to meet the operating expenses of the trade or business.

However, stock is never considered used or held for use in a trade or business for purposes of applying this test

- (4) Elimination of duplicate reporting of assets. . A specified person is not required to report a specified foreign financial asset if the specified person reports the asset on at least one of the following forms timely filed with the Internal Revenue Service for the taxable year. Form 3520, Form 5471, Form 8621, Form 8865, Form 8891.

- (5) Residents of U.S. Possessions. There is also an exclusion for a specified person who is a bona fide resident of a U.S. possession. They are generally not required to report the specified foreign financial assets that are situated, sourced or reported in the Possession of which they are a bona fide resident.

Required Information

There are different disclosure requirements based upon the character of the asset.

Stocks and Securities

In the case of stock or a security, the name and address of the issuer must be supplied and information that identifies the class or issue of which the stock or security is a part.

Financial Instruments

In the case of a financial instrument or contract held for investment, information that identifies the financial instrument or contract, including the names and addresses of all issuers and counterparties

Foreign Entities

In the case of an interest in a foreign entity, information that identifies the interest, including the name and address of the entity;

The maximum value of the specified foreign financial asset during the portion of the taxable year in which the specified person has an interest in the asset will be determined by the asset class.

Depository/Custodial Accounts

In the case of a financial account that is a depository or custodial account, whether such financial account was opened or closed during the taxable year;

The date, if any, on which the specified foreign financial asset, other than a financial account that is a depository or custodial account was either acquired or disposed of (or both) during the taxable year;

Income

The amount of any income, gain, loss, deduction, or credit recognized for the taxable year with respect to the reported specified foreign financial asset, and the schedule, form, or return filed with the Internal Revenue Service on which the income, gain, loss deduction, or credit, if any, is reported or included by the specified person;

Valuation Guidelines

The value of a specified foreign financial asset must be determined (i) for purposes of determining if the aggregate value of the specified foreign financial assets in which a specified person holds an interest exceeds the minimum and (ii) whether minimum year end reporting requirements are exceeded. The value of a specified foreign financial asset for both of these purposes generally is the asset’s fair market value. The maximum value of a specified foreign financial asset generally is the asset’s highest fair market value during the taxable year.

Valuing financial accounts

The maximum value of a financial account means a reasonable estimate of the maximum value of the holdings of the financial account at any time during the taxable year. Periodic account statement provided at least annually may be relied upon for reporting a financial account’s maximum value absent actual knowledge or reason to know based on readily accessible information that the statement does not reflect a reasonable estimate of the maximum account value during the taxable year.

Valuing other specified foreign financial assets

For purposes of determining the maximum value of a specified foreign financial asset other than a financial account maintained with a foreign financial institution, a specified person may treat the asset’s fair market value on the last day during the taxable year on which the specified person has an interest in the asset as the maximum value of the asset.

Special Valuation Rules for Beneficial Interests in Foreign Trusts, Estates, Pension Plans, and Deferred Compensation Plans

The maximum value of a specified person’s interest in a foreign estate, foreign pension plan, or a foreign deferred compensation plan is the fair market value, determined as of the last day of the taxable year, of the specified person’s beneficial interest in the assets of the foreign estate, foreign pension plan or foreign deferred compensation plan.

Entities

For purposes of reporting an individual’s interest, generally a specified person is not treated as having an interest in any specified foreign financial assets held by a corporation, partnership, trust, or estate solely as a result of the specified person’s status as a shareholder, partner, or beneficiary of such entity. However, though the entity itself may be a specified person that is required to report its holdings and indirectly that of its U.S. partners, beneficiaries and shareholders.

Furthermore, a specified person that is treated as the owner of a trust or any portion of a trust under certain circumstances is treated as having an interest in any specified foreign financial assets held by the trust or the portion of the trust.

A Foreign Currency Conversion

For purposes of meeting the reporting requirements, all values denominated in a foreign currency for purposes of determining both the aggregate value of specified foreign financial assets in which a specified person holds an interest and the maximum value of the specified foreign financial asset must be converted into U.S. dollars at the taxable year-end spot rate for converting the foreign currency into U.S. dollars (that is, the rate to purchase U.S. dollars). The U.S. Treasury Department’s Financial Management Service foreign currency exchange rate is to be used to convert the value of a specified foreign financial asset into U.S. dollars.

ARTICLE REFERENCES:

1/ FATCA provides for even more financial reporting commencing in the year 2014 when all foreign financial institutions are going to be required to diligently search for and report annually to the U.S. on financial accounts held by U.S. taxpayers.

ABOUT THE AUTHOR:

Richard S. Lehman, Esq., is a graduate of Georgetown Law School and obtained his Master’s degree in taxation from New York University.

He has served as a law clerk to the Honorable William M. Fay, U.S. Tax Court and as Senior Attorney, Interpretative Division, Chief Counsel’s Office, Internal Revenue Service, Washington D.C.

Mr. Lehman has been practicing in South Florida for more than 38 years. During Mr. Lehman’s career his tax practice has caused him to be involved in an extremely wide array of commercial transactions involving an international and domestic client base. He has served clients from over 50 countries.

For additional assistance, please fill out the form below and Richard Lehman will contact you.

THE IC-DISC

By Richard S. Lehman

The business world is going to be a tough place for the American exporter in 2013. The dollar will remain strong, keeping U.S. goods high priced, trade to the Euro zone will weaken while the cheap euro makes the Euro Zone highly competitive as exporters. China will contract and desperate competitors and countries will be trying even harder to protect their own. With export profits hard to come by, U.S. taxpayers that sell, lease or license “export property” which is manufactured, produced or grown in the United States (not more than 50% of which attributable to U.S. imports), can take advantage of strong support for their export profits in the Internal Revenue Code.

Export profits can produce substantial tax benefits with little more than establishing a new corporation dedicated almost exclusively to export profits; a separate set of export books and records, and abiding by a relatively simple set of rules that govern Domestic International Sales Corporations (now known as “IC-DISC). Rather than being organized as a mere “paper” entity for receipt of commission income only, an IC-DISC can have more substance and engage in additional export-related activities such as promotional activities, thereby enhancing its income and the benefit of the advantageous tax rates to shareholders.1/

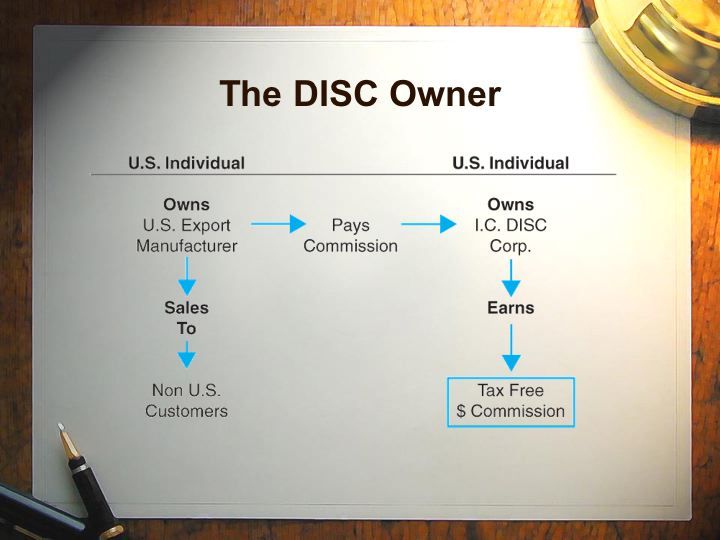

An IC-Disc is compensated by a U.S. taxpayer that manufactures, sells or licenses “export property”. Typically the U.S. taxpayer that establishes the IC-DISC will be related to the IC-DISC and even own the IC-DISC. The U.S. taxpayer agrees to pay the IC-DISC based on a Commission Agreement. A portion of the U.S. taxpayer’s export profits are paid to the IC-DISC and the payment is deducted from the profits of the U.S. manufacturer, seller or licensor. The portion of the U.S. taxpayer’s “export profits” that are paid to the IC DISC are measured under three profit scenarios. The deduction may exceed more than 50% of the U.S. Taxpayers’ export profits, depending upon gross income, profitability and costs.

In its simplest terms, the IC-DISC is a separate corporation. The income received by the DISC is not taxable to the DISC. The DISC is charged with accounting separately for a U.S. “taxpayer’s export profits” and receives more than 50% of the export profits free of any U.S. taxation.2/

The existence of the DISC will be transparent to the export company’s customers. The exporter will continue to operate its business in the same manner and its employees will continue to perform the company’s manufacturing, sales, billing, shipping and collection functions. The fact that there is a commission agreement between the exporter and the DISC will not have to be disclosed to the exporter’s customers and no documentation provided to the customers will need to indicate the existence of, or services deemed provided by the DISC.

Architects and engineers may also be surprised to learn that their services can also qualify of DISC benefits for construction projects located outside of the U.S. if professional services related to those projects can be performed in the United States.

What are the IC-DISC rules that need to be obeyed?

IC-DISC Rules

The IC-DISC must sell, lease, license or service “export property”

Export property means property:

Manufactured, produced, grown or extracted in the United States; held for sale, lease or rental, in the ordinary course of business, for use, consumption or disposition outside the United States; and Not more than 50% of the fair market value of which is attributed to articles imported into the United States.

Services Furnished by DISC

Services can also be provided by the I.C. DISC if such services are provided by the person who sold or leased the export property to which such services are related. The DISC acts as a commission agent with respect to the sale or lease of such property and with respect to such services that cannot exceed a certain amount of the value of the transaction. The service must be of the type of customarily and usually furnished with the type of transaction in the trade or business in which such sale or lease arose.

IC-DISC REQUIREMENTS

- A corporation taxable as a corporation, must be formed under the laws of any State or the District of Columbia to be the IC-DISC

- The corporation must have only one class of stock and minimum capital of $2,500. The IC-DISC shareholders may be related to the IC-DISC.

- The IC-DISC must take a tax election to be an IC-DISC that must be filed with the Internal Revenue Service within 90 days after the beginning of the tax year of the IC-DISC.

- The IC-DISC must maintain separate books and records.

- The IC-DISC must have at least 95% or more of its gross receipts considered to be Qualified Receipts resulting from the DISC’s export activities.Qualified export receipts of a DISC include gross receipts from the sale of export property by such DISC, or by any principal for whom the DISC acts as a commission agent. The transaction must be pursuant to the terms of a contract entered into with a purchaser by the DISC or by the principal at any time or by any other person and assigned to the DISC or the principal at any time prior to the shipment of such property to the purchaser. Any agreement, oral or written, which constitutes a contract at law, satisfies the contractual requirement of this paragraph.Qualified export receipts of a DISC include gross receipts from the lease of export property provided that the property is held by a DISC (or by a principal for whom the DISC acts as commission agent with respect to the lease) as an owner or lessee at the beginning of the term of such lease and entered into with the DISC for the DISC’S taxable year in which the term of such lease began.

- The IC-DISC must have at least 95% or more of its assets considered to be Qualified Export Receipts. For a corporation to qualify as a DISC, at the close if its taxable year it must have qualified export assets with an adjusted bases equal to at least 95 percent of the sum of the adjusted bases of all its assets. A qualified export asset held by a DISC is an export property that is a business asset used in the export business, export trade receivables, temporary export investments and several loans that can result from engaging in export financing techniques.

Essentially, as a practical matter, this means all IC-DISC gross receipts should be devoted almost totally to the IC-DISC operation. There is no reason to violate either of these formulas. However, there is no requirement that the IC-DISC be an actual operating company except the corporate form must be respected in all regards as with any other corporation.

“Thus the magic of the IC-DISC is to provide both tax deferral and to apply a 15% maximum dividend tax rate to profits that would otherwise be taxable in the U.S. taxpayer’s highest brackets that can range as high as 50% when city, state and federal income taxes are calculated.”

The Tax Benefits

The benefits of the IC-DISC come in two separate fashions. The IC-DISC shareholders may leave the IC-DISC profits in the IC-DISC and defer taxation until actual distribution of the profits or the IC-DISC may distribute profits to its shareholders like any other corporation. Since IC-DISC distributions are considered “qualified dividends” they are subject to a maximum tax of 15%. Thus the magic of the IC-DISC is to provide both tax deferral and to apply a 15% maximum dividend tax rate to profits that would otherwise be taxable in the U.S. taxpayer’s highest brackets that can range as high as 50% when city, state and federal income taxes are calculated.2/

Typically the IC-DISC is established, by a related company that is engaged in a United States business that includes gross revenues from both domestic and international sources. The related company’s principals will be the direct or indirect owners of the IC-DISC that may be owned directly or any transparent entity, that may be a partnership, or a disregarded entity, such as a one person limited liability company.

For the maximum tax advantage the IC-DISC shareholders should avoid double taxation by acting as individual shareholders or using disregarded entities and/or pass through entities. The IC-DISC corporation itself must be a c corporation and may not elect Sub chapter S status.

Tax Deferral

There is a cost to take advantage of the tax deferral tax benefit available using an IC-DISC. However, in today’s climate and for the foreseeable future, the cost is minimal. The IC-DISC rules provide that an “interest charge” must be calculated on IC-DISC distributions that are not paid as taxable dividends in the year earned. However, that interest charge is the same as the rates charged on one year Treasury bills that have been ranging at less than 1% per annum. Thus at this time a U.S. Taxpayer may defer the U.S. income tax on 50% or more of its export profits at a cost of less than 1% per year and then eventually distribute those export profits and their tax free earnings at the 15% U.S. dividend rate.

Major Savings

However, it is extremely important that U.S. taxpayers not be misled by the $10,000,000 annual cap on tax free income that is permitted by an IC-DISC. This $10. Million annual cap does not require the DISC pay taxes on its income of IC-DISC profits over $10.0 Million. The DISC remains tax exempt. This means that IC-DISC profits in excess of $10 Million annually will be immediately taxed to the shareholders as a DISC dividend.

Profits in excess of the $10.0 Million maximum are considered automatically annual dividends from the DISC with no deferral privileges. However, while the deferral privileges does not exist, most practitioners believe that the IC-DISC shareholders still will receive the 15% tax rate on the DISC dividends in excess of $10 Million.

The Commission Payments

The commission payments will depend upon the pricing methodology chosen by a DISC to record its share of commission income at the greater of any of the following three pricing arrangements:

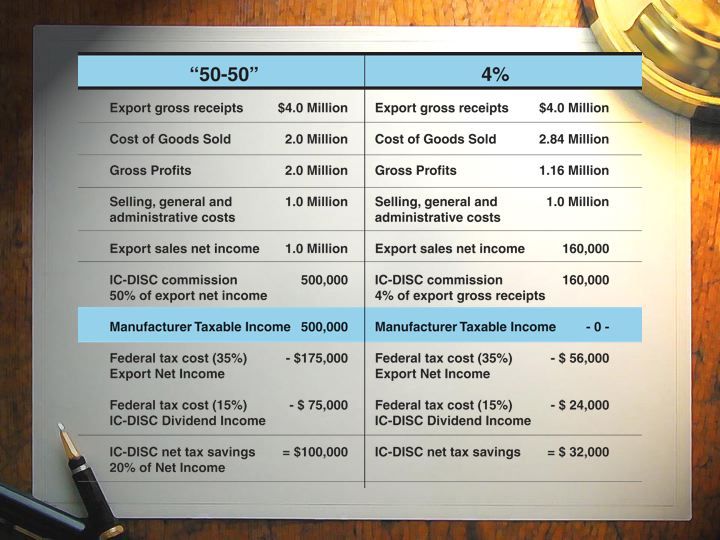

Gross Receipts Method

Under the gross receipts method of pricing, the transfer price for a sale by the related supplier to the DISC is the price as a result of which the taxable income derived by the DISC from the sale will not exceed the sum of (i) 4 percent of the qualified export receipts of the DISC derived from the sale of the export property and (ii) 10 percent of the export promotion expenses of the DISC attributable to such qualified export receipts.

Taxable Income Method

Under the combined taxable income method of pricing, the transfer price for a sale by the related supplier to the DISC is the price as a result of which the taxable income derived by the DISC from the sale will not exceed the sum of (i) 50 percent of the combined taxable income of the DISC and its related supplier attributable to the qualified export receipts from such sale and (ii) 10 percent of the export promotion expenses of the DISC attributable to such qualified export receipts.

“Export promotion expenses” means those expenses incurred to advance the distribution or sale of export property for use, consumption, or distributions outside of the United States but does not include income taxes.

Arm’s Length Method

If the rules of the preceding paragraphs are inapplicable to a sale or a taxpayer does not choose to use them, the transfer price for a sale by the related supplier to the DISC is to be determined on the basis of the sale price actually charged but subject to the rules provided by the rules of sales between related parties.

Payment

The amount of a transfer price (or reasonable estimate thereof) actually charged by a related supplier to a DISC, or a sales commission (or reasonable estimate thereof) actually charged by a DISC to a related supplier, must be paid no later than 60 days following the close of the taxable year of the DISC during which the transaction occurred.

Examples

The following are examples of the 4% Percent Gross Receipts and “50-50″ Combined Taxable Income Methods of Pricing. Neither example includes any export promotion expenses.

ARTICLE REFERENCES:

- As will be explained later, the “IC” stands for an “interest charge”. This is a cost to be paid to the extent the Domestic International Sales Corporation does not distribute its profits to its shareholders.

- IC-DISC income is also typically exempt from individual state income taxes.

ABOUT THE AUTHOR:

Richard S. Lehman, Esq., is a graduate of Georgetown Law School and obtained his Master’s degree in taxation from New York University.

He has served as a law clerk to the Honorable William M. Fay, U.S. Tax Court and as Senior Attorney, Interpretative Division, Chief Counsel’s Office, Internal Revenue Service, Washington D.C.

Mr. Lehman has been practicing in South Florida for more than 37 years. During Mr. Lehman’s career his tax practice has caused him to be involved in an extremely wide array of commercial transactions involving an international and domestic client base. He has served clients from over 50 countries.

If you have additional questions - please fill out the form below.

NEW U.S. TAX LAW Seminar Series: 5.5 hours FREE Continuing Education Course Credits

These seminars cover a complete range of topics dealing with legal and practical advice for foreign investors that invest in United States businesses, United States real estate and United States securities; and aliens that immigrate to the United States. This includes income, estate and gift tax planning for nonresident alien individuals and foreign entities such as foreign corporations, foreign trusts and foreign partnerships. Special sections are devoted to foreign investors in United States Real Estate, Tax Planning and Pre Immigration Tax Planning.

Also included in this group of seminars is a thorough study of the United States tax laws governing the tax deductions and tax refunds available for victims of Ponzi Schemes and other theft losses under the Internal Revenue Code Section 165. www.ustaxlawseminars.com

WATCH A SHORT OVERVIEW OF SEMINAR FORMAT: