Question 1 Will a taxpayer qualify for the Streamline Program if they are under examination? a) Yes b) No c) They will qualify unless they are under criminal examination Question 2 Can a U.S. Taxpayer who is living in the…

Top 10 Questions On Ponzi Scheme Theft Losses And Clawback Payments

Testimonials from the Realtor’s Association of the Palm Beaches

Tax Planning Techniques for the Foreign Real Estate Investor can be a complicated topic. Recently Richard S. Lehman presented an “advanced” course on this topic to a group from the Realtors Association of the Palm Beaches. The overwhelming consensus was…

Real Estate Sales to Foreign Investors in Billion Dollars

The National Association of Realtors states that approximately 55% of reported foreign transactions of purchases by international clients are cash. They say that mortgage financing tends to be a problem for non-resident international clients due to financial profiles that are…

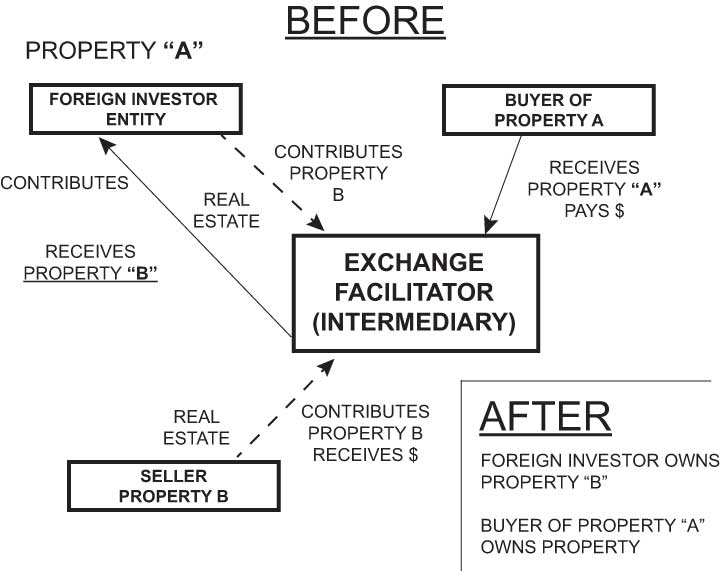

Tax Deferral: Delayed Tax Payment On Gains

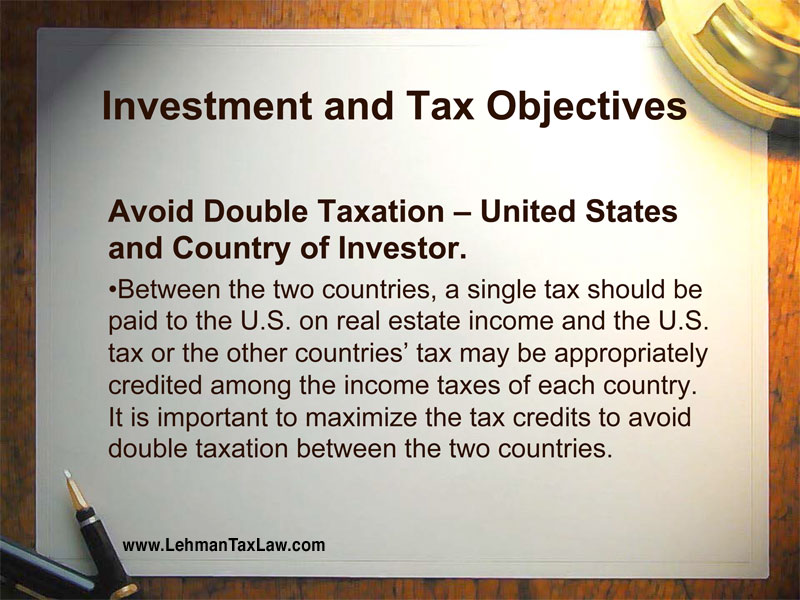

Meeting The International Client’s Needs

Handling Offshore Voluntary Disclosure and IRS Streamlined Cases

How do I request pre clearance before I submit any offshore voluntary disclosure to the IRS? For the OVDP, pre clearance may be requested as follows: 1. Taxpayers or representatives send a facsimile to the IRS – Criminal Investigation Lead…

The IRS has three separate programs that can help many American taxpayers become compliant and not broke.

This article has been translated into Deutsch – A general overview of United States Taxation of Foreign Investors

Besteuerung von ausländischen Investoren in den U.S.A. by Richard S. Lehman Esq. U.S.-Besteuerung von ausländischen Firmen und nicht-ansässigen Ausländern Allgemeine Regeln Steuerplanung vor der Einwanderung in die U.S.A. Steuerplanung für den ausländischen Immobilien-Investor EINFÜHRUNG Die Vereinigten Staaten waren seit langem…

ebooks now available from Amazon by Tax Attorney Richard S. Lehman, Esq.

These ebooks are part of Lehman Tax Law knowledge-based learning. On-demand videos on all topics of United States Taxation are offered at no cost and available at www.USTaxLawSeminars.com Taxation of the Clawback in a Ponzi Scheme - Maximum Recovery US:…