Posts Tagged ‘united states taxation of foreign investors’

To Members of the Bar and other Professionals.

In this ever expanding global world; consider Richard S. Lehman, Esq., and LehmanTaxLaw.com as your in-house international tax law office. Don’t lose clients because you cannot supply the “tax law” piece of the puzzle. Lehman Tax Law has mastered the art of providing international tax advice by internet and will travel where warranted. Arrangements can be made for simultaneous translations and speedy delivery of translated documents in 10 languages to best help service your client.

Mr. Lehman understands professionals are now frequently dealing with alien individuals or foreign corporations investing in, doing business in, or moving to the United States; and/or Americans investing and doing business outside of the United States, or emigrating from the United States. This means that more and more professionals are going to deal with the U.S. tax laws and the world.

The best rule to follow in the field of tax law is to plan legal matters and obtain precision advice in advance to insure commercial endeavors are completed at minimum tax costs and personal lives are minimally disrupted. This is even more the case in the international field.

Mr. Lehman has been around long enough and experienced enough to know that the world of commerce is far from a perfect world. He knows how to apply his knowledge, experience and relationships just as effectively to resolve the unplanned and unexpected legal obstructions that arise in transactions that often lead to failure if not dealt with correctly. It is important to know – Mr. Lehman is just as good in cleaning up the legal mess of others – as making sure a legal mess does not happen in the first place.

For 37 years Richard S. Lehman has been a resource of knowledge in the area of United States taxation. After graduating Georgetown Law School, the New York University Law School Masters program in Taxation and serving as a law clerk on the U.S. Tax Court and with the Chief Counsel’s Office in the Internal Revenue Service in Washington D.C., Lehman has practiced U.S. tax law for 37 years with an emphasis on its international aspects. He has served clients from over 50 countries.

Please contact Mr. Lehman if you require his tax law expertise.

NEW U.S. TAX LAW Seminar Series: 5.5 hours FREE Continuing Education Course Credits

These seminars cover a complete range of topics dealing with legal and practical advice for foreign investors that invest in United States businesses, United States real estate and United States securities; and aliens that immigrate to the United States. This includes income, estate and gift tax planning for nonresident alien individuals and foreign entities such as foreign corporations, foreign trusts and foreign partnerships. Special sections are devoted to foreign investors in United States Real Estate, Tax Planning and Pre Immigration Tax Planning.

Also included in this group of seminars is a thorough study of the United States tax laws governing the tax deductions and tax refunds available for victims of Ponzi Schemes and other theft losses under the Internal Revenue Code Section 165. www.ustaxlawseminars.com

WATCH A SHORT OVERVIEW OF SEMINAR FORMAT:

America continues to be the ultimate destination point for many wealthy immigrants. Some from countries with taxes higher than the U.S. but most from countries with either lower taxes than the U.S. or countries with higher taxes that for all practical purposes are circumvented to one degree or another.1

An immigrant coming to America for longer than a certain time period will become a Resident Alien for U.S. income taxes at some point in time. In doing so, they are subjecting themselves to a potential U.S. tax income on their annual worldwide income, an estate tax on their deaths on their worldwide assets and a tax on gifts of their worldwide wealth.2

Presently the United States taxes its citizens on their worldwide income and gains. The tax is on net income and the U.S. tax code provides for numerous deductions and tax credits in arriving at net income. The tax rates on net ordinary income start at a rate of 15% and graduate to a high of 35% on $10.0 Million or more.

There is a different tax rate for gains from the sale of investment assets and other capital assets. Gains from the sale of capital assets held for more than a year have a maximum tax of 15%.

These income taxes can be mitigated to one extent or another for the potential u.s. immigrant, by careful tax planning before the immigrant becomes a resident alien.

Tax Residency in the U.S.

The first step in income tax planning is for the Nonresident alien who is immigrating to the U.S., to determine exactly when that immigrant will become a Resident Alien for income tax purposes.

The general rule is that an alien is not considered to be a Resident Alien for U.S. income tax purposes if the alien does not have either (1) a green card representing permanent residency in the U.S. or (2) a “substantial presence” or time period in the U.S. as described below. There are exceptions to this “substantial presence” general rule that will also be discussed.

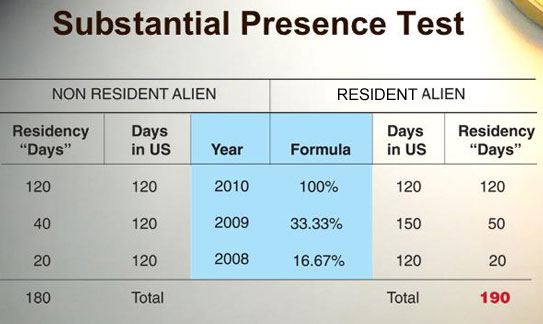

An alien individual has a “substantial presence” in the United States, or may become a Resident Alien subject to tax on worldwide income for any calendar year in which the alien is both physically present in the U.S. for at least 31 days and; in that same calendar year is considered to have been in the U.S. for a combined total of 183 days or more over the past three years pursuant to a formula.

For purposes of calculating this combined 3 year, 183-day requirement; each day present in the United States during the current “combined” calendar year counts as a full day, each day in the preceding year as one-third of a day and each day in the second preceding year as one-sixth of a day. This is shown on the example below.

The United States has tax treaties with many countries. These treaties generally provide that the residents and corporations of each country are entitled to a more liberal tax treatment than residents and corporations of non-treaty countries. The concept of tax residency under the treaties is usually different than the general definition and may permit a nonresident alien to spend more time in the U.S. each year without being a U.S. tax resident. Generally, the tax treaties will permit the alien individual to remain a non-resident for U.S. tax purposes so long as the alien covered by the treaty stays less than 183 days in the U.S. each separate year; and not over the cumulative three year period.

This same type of treatment that is granted under the Treaty, that of permitting aliens to have an extended stay in the U.S. of less than 183 days in each year without becoming a U.S. tax resident, is also available to certain aliens that are not from countries governed by a U.S. tax treaty. If an alien has his or her provable most important business ties to his or her native country; the substantial presence test is extended due to their “closer connection” to a foreign country than to the U.S.

The “Income Tax Residency Starting Date”

Generally there will be a specific point in time when the Nonresident Alien becomes a “Resident Alien” for U.S. tax purposes. This is an important date since it represents a total change in tax regimes and the point in time when all of the individual’s tax planning as a nonresident alien must be completed if it is to be successful. Pre Immigration tax planning generally cannot be accomplished after the Residency Starting Date.

There are different starting points of “income tax residency” during the year, depending upon the circumstances of obtaining the residency. Those are known as the “Residency Starting Dates”.

For example, once the alien individual has passed the “substantial presence test”, the individual is considered to be a Resident Alien from the beginning of the calendar year in which the test was exceeded.

On the other hand an individual who becomes a Resident Alien because of the issuance of a “green card” that represents permanent residency does not have a Residency Starting Date for tax purposes until that point in time during the year that the alien has received the green card and is present in the United States. However, if a “green card” recipient is a resident under both the green card test and the “substantial presence test”, the taxpayer’s taxable year is the full calendar year and not that date of the year in which the substantial presence in the U.S. physically began.

Missing a Residency Starting Date for the completion of pre residency tax planning transactions often will be fatal.

The Income Tax Objectives

1. A Nonresident Alien, prior to becoming a U.S. tax resident will want to make sure that he or she does not have to pay a U.S. tax on gains that have accrued as a practical matter before their residency period. The first strategy is to accelerate (realize and recognize) any and all gains earned by the Taxpayer prior to becoming a Resident Alien.

2. The second key strategy is to accelerate income that is expected to be paid after residency. Income payments should be collected prior to residency to avoid being taxed by the U.S.

3. The third strategy is to defer recognizing a loss until after obtaining tax residency as a Resident Alien so that the loss can be used against post residency gains. Assets with a fair market value below cost can be sold after residency. Those losses may be taken against gains in assets earned after U.S. residency. These losses can reduce or wipe out gains from the sale of assets that accrue after U.S. residency.

4. The fourth strategy is to defer paying deductible expenses until after the Residency Starting date. Many types of payments (both business and personal) in the U.S. are deductible from a U.S. Taxpayer’s income to determine the actual taxable amount of income.

ACHIEVING THE OBJECTIVES

Accelerate Gains Prior to Residency Starting Date

An example of acceleration would be to trade securities with unrealized gains and sell them before residency. There would be no tax on the gain. If the Taxpayer cares to keep the shares, the taxpayer can repurchase the shares immediately with a new high cost basis for U.S. tax purposes.

Assume a nonresident alien owned $1.0 Million Dollars worth of shares of Ford Motor Company that was purchased for $100,000. If the shares are sold after U.S. tax residency is assumed when the immigrant is a Resident Alien, there will be a tax on $900,000 in gains. A sale of these same shares by a Nonresident Alien before becoming a Resident Alien would result in no taxable gain.

There are multiple ways to accomplish this acceleration of gain. Another example would be that of an individual who owned a private foreign corporation that was not listed and could not be bought and sold on an exchange. Assume, like the prior example, the owner has a cost basis in the shares of $100,000 and the corporation is worth One Million Dollars. A liquidation of the corporation prior to the Residency Starting Date may result in the owner having a new cost or “tax basis” in the assets of the corporation received in the liquidation. This would be the $1.0 Million fair market value of the assets received. Assume a sale of these assets after the residency starting date for a purchase price of $1,200,000. This would only produce a taxable profit for U.S. tax purposes for $200,000

Under certain circumstances appreciated assets can be sold for tax purposes to a trust or family members to accomplish the increased basis for tax purposes of the appreciated assets. This allows the transferor to retain certain rights in the asset in spite of the transfer to another entity or person. Each asset must be carefully dealt with on an individual basis.

One extremely favorable U.S. Internal Revenue Service announcement has ruled that if a nonresident alien sells an asset prior to becoming a Resident Alien for a promissory note and not immediate cash, the proceeds of the note when received will not be considered taxable even after the residency starting date. The sale is considered to be completed and the funds are earned for tax purposes when the sale took place during the Taxpayer’s Non Resident Alien statue.

An example of the above might find a non resident alien father selling a valuable painting worth millions more than its cost to his nonresident alien son for a Promissory Note. The purchase price cash payment on the Promissory Note can be made tax free to the father when the son later sells the painting and after the father immigrates to the U.S. This is because the sale to the son realizing the gain was made prior to the Resident Alien starting date.

A sale by the son of the painting after the Residency Starting date will result in no taxable gain to the father to the extent of the original sales price. Amounts paid in excess of this would be taxable only to the son who most likely is not subject to U.S. taxes.3

There are several sophisticated and complex tax moves or actual sales that can be completed to accomplish this increase in basis or actual sales when foreign corporations comprise some or most of the would be immigrant’s wealth.

Accelerate Income Prior to Residency Starting Date

So long as an immigrating alien is not a Resident Alien, any and all income items that the Non Resident Alien earns from non U.S. sources before becoming a Resident Alien, should be accelerated for tax purposes so that the recognition of this income occurs prior to the taxpayer becoming a resident alien. This can include a host of different types of income, all of which may be treated in different ways in order to accomplish the acceleration of the income.

For example, assume a non resident alien owns a foreign corporation that conducted a business in his home country that now has $1 Million in receivables that will not be collected until after the owner has become a Resident Alien for U.S. tax purposes.

These receivables might be accelerated, for example, by the liquidation of the taxpayer’s company and the transfer of the receivables to the taxpayer at their present fair market value, prior to the Residency Starting Date.

The taxpayer may also sell his interest in the company or to the company for a Promissory Note. The ongoing foreign company may collect the receivables which are then paid to the seller and Non Resident Alien, in payment of the Promissory Note he received to sell his shares to the company.

Another type of deferred income that should be accelerated prior to U.S. tax residency is money from deferred compensation plans, such as pensions and profit sharing plans. Early releases and distributions of these type of payments in a lump sum from the plan would prevent the taxation of the distributions after one becomes a Resident Alien. In fact, there are several sophisticated techniques involving both annuities and life insurance products that could be very helpful in this regard. This same principal can apply to the acceleration of stock options and other forms of deferred and incentive compensation.

Actually any type of non U.S. periodic payment that the immigrating non resident alien can receive in advance prior to becoming a Resident Alien should be sought. For example, rental payments on personal property and real property can be paid in advance as can royalties and license fees, and even interest payments on promissory notes. If the immigrating taxpayer is not in a country where the taxes on these types of income are extremely low, there is a good deal of tax savings in paying attention to the acceleration of income items.

Defer Recognizing Loss

In today’s times there are many wealthy immigrants coming to the U.S. who have significant losses in their investment portfolios from the last few years. If it is economic, these portfolios should not be liquidated and losses should not be realized and recognized prior to immigration to the U.S; as they can be extremely valuable to use against capital gains in the U.S.; and even against ordinary income in the U.S. under certain circumstances.

Assume a non resident alien taxpayer from Panama has purchased a Panama apartment at the high end of the market for $4.0 Million, and it is worth $3.0 Million before he immigrates to the United States. Assume the Panamanian taxpayer will be immigrating to the U.S. effective January 1, 2011. Assume that same taxpayer invests $100,000 in a Florida corporation after obtaining tax residency and sells the Florida corporation after obtaining Resident Alien status for $1 Million in excess of its cost to the Panamanian investor.

In the event the investor were to sell his Panama apartment at a loss prior to becoming a Resident Alien and then sell his profitable Florida corporation at a gain in the following year when he is a Resident Alien, there will be a capital gains tax on the $1.0 Million gain at a cost of $150,000. Had the Panama apartment8 been sold in the year of Residency there would be no tax cost at all since as a Resident Alien, the taxpayer would pay a tax on all of his worldwide net losses and gains, thereby reducing his U.S. gains by his Panama losses.

Deferring the Payment of Deductible Expenses

The same principal that would work in deferring the payment of losses is also present in the principal of deferring the payment of deductions from the year of non residency to the year of tax residency.

The United States has a complicated tax code and offers numerous different “personal deductions” and “investment” or “business deductions” that will reduce the taxpayers overall tax burden. Most of these deductions are available only in the year of payment and several are subject to limitations. Nevertheless, an immigrating taxpayer should be familiar with the deductions that can be deferred.

One simple example. There is a limited deduction for medical expense that can reduce the taxpayer’s taxable income if those medical expenses are paid after obtaining Resident Alien status, they might reduce the taxpayer’s overall taxable income.

Preparing for the Future

Finally, the immigrating Non Resident Alien must prepare for a tax life as a Resident Alien. This means taking advantage of all of the tax deductions and tax investment incentives offered by the U.S. Tax Code. It may actually mean leaving certain of the taxpayer’s foreign investments in place. This is also the subject of a separate article on the Taxation of Immigrating to the United States.

FOOTNOTES:

- This article focuses on foreign individuals that are not U.S. citizens but who nevertheless may be classified as a U.S. resident for U.S. income tax purposes. (“Resident Alien”). A non-citizen who is classified as a nonresident for U.S. income tax purposes is referred to herein as a “Nonresident Alien”.

- This Article is directed only to income tax planning. A forthcoming Article will consider Estate Tax Planning for the U.S. Immigrant. All of the income taxes discussed are subject to numerous exclusions, deductions and tax planning techniques that make the U.S. taxes within reason. However, the immigrant from countries where the taxing authorities are lax will find the U.S. taxing authorities to be very vigilant.

- It is important to note that not all of an immigrating alien’s foreign assets need to be sold or exchanged or otherwise alienated. Good tax planning when one becomes a Resident Alien for tax purposes may mean keeping good foreign investments. Such assets will often fit well in the overall scheme because the U.S. taxes, on certain types of foreign income from outside the United States that is earned in a business, can be deferred and paid at a later point in time when the cash from the foreign business is actually distributed to the taxpayer.

Once you have read this article, please visit this free online seminar dedicated to pre immigration tax planning. The seminar pre immigration seminar is free.

This is principally an article about tax planning for the non resident alien individual and foreign corporate investor that is planning for larger size investments in United States real estate (“Foreign Investor”). That is investments of One Million Dollars ($1,000,000) or more.1

As a result of 35 years of Florida real estate experiences with foreign investors that purchase shopping centers, rental apartments, rental apartment houses, warehouses, land acquisitions and real estate development deals of all types, this article also has a few practical suggestions for the Foreign Investor.

In my judgment the first suggestion is that today the Foreign Investor has the time to think about making your purchase and it need not be hurried but one cannot wait for all of the signs of correction before committing. The U.S. real estate market is very depressed. At the same time the U.S. real estate market will not be depressed forever and may turn quickly when it turns.

Next, use only a very limited amount of borrowed funds. Because the U.S. real estate market is heavily depressed, it is extremely difficult at this time and full of opportunities and traps. The first trap is to finance your real estate with debt that requires an immediate need for funds to finance real estate that may not be leased or sold for a considerable time. You must be prepared for long term holding even if you are thinking short term.

Third, one must seek good professionals in the United States who are also knowledgeable about the needs of the foreign investor. You must have an independent tax lawyer, real estate lawyer, an accountant and several property appraisers to rely on.

Next, do not buy 2nd and 3rd class just because of its price. Buy first class. You can do this today in America and buy for great prices.

Tax planning for the foreign investor acquiring real estate with cash investments in the range of approximately $1,000,000 or more requires a look at both the U.S. income tax consequences and the U.S. estate and gift tax consequences.

Definitions of U.S. Taxes

The foreign investor will need to be concerned about three separate U.S. taxes. They are the income tax, the estate tax and the gift tax.2

There is a U.S. income tax that is applied on annual net income which starts at 15% and can be as high as 35% for both corporations and individuals. There is a tax on capital gains from the sale of assets which is only 15% to an individual taxpayer, but may be as high as 35% to a corporate taxpayer.

There is an estate tax when a non resident alien individual dies owning U.S. real estate or shares of certain types of entities that own U.S. real estate. The first $60,000 of value is excluded. Thereafter this estate tax can be as high as 45% of the equity value of the real estate.

There is also a gift tax if a non resident alien individual gifts U.S. real estate to a third party. This can be as high as the estate tax, depending upon the value of the gift.

The Individual Foreign Investor – The Problem of the Estate Tax

As a general rule, the individual foreign investor that invests in United States real estate in equity amounts of $1,000,000 or more is going to be forced to use a corporation formed outside of the United States (Foreign Corporations) somewhere in their investment structure if they are going to avoid the U.S. estate tax.

There are many exceptions to this general rule but it is still the general rule. The United States Estate tax is so onerous that the individual Foreign Investor will generally not want to assume the risk of his or her estate having to pay the United States a large tax on the death of the individual foreign owner.

The estate tax may not be a factor if one of the exceptions apply. For example, if the Foreign Investor is from a country with whom the United States has an Estate Tax Treaty, the U.S. estate tax may not apply to that foreign individual.

Furthermore, if the individual Foreign Investor is from a country that has its own high estate tax, then the U.S. estate tax may not be of concern because it can be credited against the Foreign Investor’s estate tax of his or her own country, so that there is no double estate tax.

However, for the most part, the individual Foreign Investor will have to rely on owning a Foreign Corporation as a holding company or as the direct owner of the U.S. real estate investment.

The problem with this solution to the U.S. estate tax by owning a Foreign Corporation is that in protecting the Foreign Investor from the U.S. estate tax, that Investor will generally have to pay a higher income tax from rental income that may be earned and on the ultimate sale of the assets because there is a higher tax on capital gains earned by corporations as opposed to individuals.

Term Life Insurance

Another alternative to having the best of both worlds from a U.S. tax standpoint is that an investor can pay United States income taxes as an individual investor or as a limited liability company while not being concerned with the effect of United States estate taxes in the event of a premature death by buying life insurance equal to the potential U.S. estate tax exposure. That alternative is for the Foreign Investor to acquire sufficient “term life insurance” that pays only a death benefit for the contemplated life of the investment. Depending upon the age of the investors, this may be an inexpensive solution.

As an example, assume an investor invests one-half of One Million Dollars in United States real estate which doubles in value and is still held by the Foreign Investor but worth One Million Dollars upon the foreign investor’s death. Assume a United States estate tax of $350,000 on the value of United States real estate. The annual cost of a $350,000 life insurance policy for say a ten year period only of a relatively young man or woman will not be at all prohibitive from a cost standpoint.

Income and Capital Gains Tax

With all of this in mind we can review the various options of U.S. real estate ownership by the larger Foreign Investor.

1. Individual Ownership of U.S. Real Estate.

An individual Foreign Investor may own U.S. real estate in his or her own individual name. This represents the simplest form of ownership with the least amount of paperwork involved. If it is rented out the individual owner will have to file a U.S. income tax return personally reporting the U.S. income.

This form of ownership is only chosen by a small percentage of Foreign Investors. This is for at least two reasons. The first reason is liability. The owner of U.S. real estate will be personally liable for any damages that result from that real estate. While often insurance is more than sufficient to cover such claims, most investors do not want to expose themselves personally to individual liability.

Furthermore, investors from many countries are fearful of revealing their wealth for security reasons, particularly if it is a large investment. An investor’s individual name as an owner of U.S. real estate will appear in the public records where that real estate is located.

This form of ownership does however provide the best income tax benefits. The individual investor will pay tax only on the investor’s U.S. income. Because of expenses and depreciation deductions, the Investor may only pay a tax from operations in a relatively small tax bracket.

The tax on the profit from the gain from the sale of the real estate will be only 15%.

If one does choose to own U.S. real state individually, the foreign individual investor may be subject to an estate tax in the event that investor was to die owning the U.S. real estate.

2. Limited Liability Company Ownership.

Foreign Investors may use an entity acceptable in every state in the U.S. known as a limited liability company. This type of company is treated as if it does not exist for U.S. tax purposes and therefore the tax consequences of owning a United States limited liability company that owns U.S. real estate is similar to the tax consequences described for the individual foreign investor above. A U.S. estate tax will apply to U.S. real estate owned by a limited liability company.

However, the big difference is that the limited liability company, as the name says, provides the investor with limited personal liability for losses related to the real estate investment.

What this means is that the individual foreign investor’s personal assets are not exposed to the liabilities of the investment. The limited liability company provides for the best income tax treatment and limited liability for the investor’s wealth.

3. U.S. Domestic Corporate Ownership.

The use of a United States corporation by an individual Foreign Investor who invests in the United States real estate is very limited by itself. That is because shares of stock in a United States corporation that owns U.S. real estate are also included in the foreign investor’s estate, if the foreign investor dies owning those shares. Thus ownership of a U.S. corporation to own U.S. real estate does not solve any U.S. estate tax problems. It does, however, create an extra tax burden for the foreign investor in United States real estate. That is because there will be an income tax on a United States corporation on the gain of the sale of the real estate asset that can be higher than the tax on the foreign individual investor. Unlike the tax on an individual, which is limited to 15%, the corporate tax can be as high as 35%.

There is however, one situation in which investment in United States real estate by the ownership of a United States corporation does make sense. If is as follows:

Gift of Shares

If the individual foreign investor intends to ultimately make a gift of his or her shares in a United States company that owns U.S. real estate to third parties, such as family members, etc., there will be no U.S. gift tax asserted on the gift of those shares. There would have been a U.S. gift tax had the real estate been given directly. Thus, the estate tax may be avoided with no gift tax payable if shares in a United States corporation that owns U.S. real estate are transferred prior to the foreign investor’s death.

4. The Foreign Corporation.

As a general rule, it is not a good idea for a foreign investor to use a foreign corporation that will then directly invest in U.S. real estate. This is because foreign corporations that invest in U.S. real estate can be subject not only to U.S. corporate income taxes but might also be subject to a branch tax equal to 30% of the foreign corporate investors’ undistributed U.S. profits.

A foreign corporation is, nevertheless, very often the investment vehicle of choice for a foreign investor that is investing significant amounts of money in U.S. real estate, such as $1 Million or more. This is because estate tax becomes a major potential liability for substantial fortunes invested in U.S. real estate and U.S. estate taxes may be completely avoided if the individual Foreign Investor owns a foreign corporation that may in turn own the U.S. real estate.

There are no estate taxes in this situation because when the Foreign Investor dies owning the U.S. real estate indirectly, the Foreign Investor only transfers to his or her beneficiaries, shares in the foreign corporation and there is no direct transfer of an interest in U.S. real estate.

This more complicated structure, in knowledgeable hands permits many tax planning opportunities.

U.S. estate taxes may be completely avoided if the individual Foreign Investor owns a foreign corporation that may in turn own the U.S. real estate.

5. Foreign Corporations and U.S. Corporations.

A more typical structure for a large investment in U.S. real estate is for the individual Foreign Investor to establish a 100% owned Foreign Corporation that becomes the 100% owner of a United States corporation that ultimately owns the U.S. real estate. For example, if the Foreign Investor were to establish a foreign corporation that became the 100% owner of a United States corporation that owned United States real estate, the Foreign Investor will be able to avoid any United States estate tax completely since nothing in the U.S. is transferred in the event of the death of the Foreign Investor.

The Tax Planning Opportunities

The more complicated structure of establishing a Foreign Corporation that owns a U.S. corporation that owns larger U.S. real estate investments provides several opportunities for income tax planning.

Liquidation of Company

The principal tax planning tool of the use of the Foreign Corporation that owns a U.S. corporation to own its U.S. real estate is to make sure that when the United States real estate is sold by the U.S. Corporation, that U.S. Corporation must be liquidated after the sale. In this fashion only one single U.S. tax is paid at the U.S. corporation level. The proceeds of sale may be transferred free of tax by the U.S. corporation after it has paid its U.S. tax if it is liquidated after the sale.3

Portfolio Loans

Another often used tax planning tool is known as the “Portfolio Loan”. As a general rule a Foreign Corporation or a U.S. Corporation that owns U.S. real estate will be able to deduct as a business deduction all of the expenses of that ownership, which include the payment of interest on loans made to acquire the real estate. As a general rule, loans made by a Foreign Investor to his or her own Foreign Company, U.S. Company or Limited Liability Company will be deductible by the company. However, the payment of such interest to the Foreign Owner of the company may be subject to a tax as high as 30% on the gross interest paid to the investing company’s foreign shareholder.

There is, however, a major exception to this general rule provided in the Internal Revenue Code. That is that a Foreign Investor who owns less than 10% of the real estate investment will be able to receive the interest that is deductible by the Foreign Company free of any U.S. tax whatsoever. This rule does not work in the event the investor owns 10% or more of the real estate investment or the entity that owns that real estate investment.

However, it is a useful planning tool in many situations where more than one investor is involved. In those situations where a portfolio loan can be used, the U.S. taxes on the income earned from the real estate investment will be reduced for the interest expense payable to the Foreign Investor without the payment of tax on that interest.

“. . . the U.S. taxes on the income earned from the real estate investment will be reduced for the interest expense payable to the Foreign Investor…“

Portfolio Loan Sales

There is another way to take advantage of the Portfolio Loan exclusion for interest paid to Foreign Investors. This can be accomplished at the actual time of sale by a Foreign Investor of his or her U.S. investment. To understand this, it is important to keep in mind that the portfolio interest deduction and exclusion from income is only appropriate if the Foreign Investor no longer has a 10% or less interest in the property.

Therefore a Foreign Seller may wish to sell the property, not for all cash but rather for cash and the balance due in the form of a note payable by the U.S. Buyer to the Foreign Seller who no longer owns any part of the U.S. real estate. At that point the Foreign Seller will be receiving tax free interest from the note that the Foreign Seller holds as a result of the U.S. real estate and the property can be used to secure the note until its full payment. This method of converting what otherwise might be taxable sales proceeds into tax free interest income could be of significant tax value under the right circumstances.

Like Kind Exchanges

Another method used by both Foreigners and Americans alike to grow their U.S. real estate portfolios free of U.S. tax is to make use of the “Like Kind Exchange Rules”. Essentially these rules hold that an investor in U.S. real estate may exchange the U.S. real estate project that they own for a different U.S. real estate project without paying any immediate tax on any gain or profit that may be accrued in the first investment.

For example, assume a Brazilian investor owns a U.S. corporation which owns raw land that the investor purchased for $ 3 Million. Assume the raw land is now worth $6 Million and the investor wishes to terminate his investment in the raw land and instead own an income producing asset such as a shopping center. Assume the shopping center is worth $ 6 Million.

Even though the raw land has increased in the amount of $ 3 Million, none of that gain will be recognized or will it become taxable until the Corporation actually sells the real estate that it has acquired as part of the exchange. At that point the investor’s investment in the shopping center has its original cost of $3 Million and any gain over and above that would be taxable if the shopping center were later sold.

… selling shares of a foreign corporation would result in no tax whatsoever being paid by the foreign entity trust on the shares of these stock.

Sale of Stock in a Foreign Corporation

In addition, on rare occasions, it has been possible for foreign investors to sell their shares in the Foreign Corporation that owns U.S. real estate to a third party buyer. It is clearly understood that selling shares of a corporation that owns real estate, instead of the actual real estate is not typical. However, this transaction, of a foreign entity selling shares of a foreign corporation would result in no tax whatsoever being paid by the foreign entity trust on the shares of these stock. There is a market for such transaction in the U.S. in specialized cases.4

FOOTNOTES:

- See article “Tax Planning for Foreign Investors Acquiring Smaller ($500,000 and under) United States Real Estate Investments” for a companion article on Tax Planning for Foreign Investors Acquiring Smaller United States Real Estate Investments.

- In addition, several of the individual states in the U.S. charge their own separate income tax on income earned in that state.

- Often one Foreign Corporation may be used as a holding company and will set up several U.S. corporations to own different projects. That way each U.S. Corporation may be liquidated on a deal by deal basis, leaving the Foreign Corporation in place.

- Another estate planning tool that allows a non resident alien investor to invest in United States real estate without incurring U.S. estate tax is the use of a Non Grantor Trust. This is a devise whereby the investor purchases the U.S. real estate using a foreign trust and foreign beneficiaries, such as family members, so that trust will ultimately benefit others. This vehicle is specifically not being discussed in this article since it does involve the investor’s alienation of the property to a trust that is extremely restrictive of any powers that the investor can have over the real estate owned by the Non Grantor Trust.

Richard S, Lehman, Esq.

TAX ATTORNEY

6018 S.W. 18th Street, Suite C-1

Boca Raton, FL 33433

Tel: 561-368-1113

Fax: 561-368-1349

Richard S. Lehman is a graduate of Georgetown Law School and obtained his Master’s degree in taxation from New York University. He has served as a law clerk to the Honorable William M. Fay, U.S. Tax Court and as Senior Attorney, Interpretative Division, Chief Counsel’s Office, Internal Revenue Service, Washington D.C. Mr. Lehman has been practicing in South Florida for more than 35 years. During Mr. Lehman’s career his tax practice has caused him to be involved in an extremely wide array of commercial transactions involving an international and domestic client base.

By Richard S. Lehman, ATTORNEY AT LAW

This is principally an article about tax planning for the non resident alien individual and foreign corporate investor that is planning for smaller size investments in United States real estate (“Foreign Investor”).1

As a result of 35 years of Florida real estate experiences with foreign investors that purchase condominium units, smaller homes and many other forms of U.S. real estate investments, this article also has a few practical suggestions for the Foreign Investor.

The first suggestion is that today the Foreign Investor has the time to think about making your purchase and it need not be hurried. The U.S. real estate market is very depressed. At the same time the U.S. real estate market will not be depressed forever.

Next, use only a very limited amount of borrowed funds. Because the U.S. real estate market is heavily depressed, it is extremely difficult at this time and full of opportunities and traps. The first trap is to finance your real estate with debt that requires an immediate need for funds to finance real estate that may not be leased for a considerable time. You must be prepared for long term holding even if you are thinking short term.

Third, one must seek good professionals in the United States who are also knowledgeable about the needs of the foreign investor. You must have an independent tax lawyer, real estate lawyer, an accountant and several property appraisers to rely on.

Next, do not buy 2nd and 3rd class just because of its price. Buy first class. You can do this today in America and buy for great prices.

Tax planning for the foreign investor acquiring real estate with cash investments in the range of approximately $500,000 or less requires a look at both the U.S. income tax consequences and the U.S. estate and gift tax consequences.

Definitions of U.S. Taxes

The foreign investor will need to be concerned about three separate U.S. taxes. They are the income tax, the estate tax and the gift tax.2

There is a U.S. income tax that is applied on annual net income which starts at 15% and can be as high as 35% for both corporations and individuals. There is a tax on capital gains from the sale of assets which is only 15% to an individual taxpayer, but may be as high as 35% to a corporate taxpayer.

There is an estate tax when a non resident alien individual dies owning U.S. real estate or shares of certain types of entities that own U.S. real estate. The first $60,000 of value is excluded. Thereafter this estate tax can be as high as 45% of the equity value of the real estate.

There is also a gift tax if a non resident alien individual gifts U.S. real estate to a third party. This can be as high as the estate tax, depending upon the value of the gift.

With all of this in mind we can review the various options of U.S. real estate ownership.

1. Individual Ownership of U.S. Real Estate

An individual foreign investor may own U.S. real estate in his or her own individual name. This represents the simplest form of ownership with the least amount of paperwork involved. If it is rented out the individual owner will have to file a U.S. income tax return reporting the U.S. income.This form of ownership is only chosen by a small percentage of foreign investors. This is for at least two reasons. The first reason is liability. The owner of U.S. real estate will be personally liable for any damages that result from that real estate. While often insurance is more than sufficient to cover such claims, most investors do not want to expose themselves personally to individual liability.Furthermore, investors from many countries are fearful of revealing their wealth for security reasons. An investor’s individual name as an owner of real estate will appear in the public records where that real estate is located.This form of ownership does however provide the best income tax benefits. The individual investor will pay tax only on the investor’s U.S. income and will probably only pay a tax from operations in a relatively small tax bracket. The tax on the profit from the gain from the sale of the real estate will be only 15%. If one does choose to own U.S. real state individually, the foreign individual investor will be subject to an estate tax in the event that investor was to die owning the U.S. real estate.

2. Limited Liability Company Ownership

Foreign investors may use an entity acceptable in every state in the U.S. known as a limited liability company. This type of company is treated as if it does not exist for U.S. tax purposes and therefore the tax consequences of owning a United States limited liability company that owns U.S. real estate is similar to the tax consequences described for the individual foreign investor above.However, the big difference is that the limited liability company, as the name says, provides the investor with limited personal liability for losses related to the real estate investment.What this means is that the individual foreign investor’s personal assets are not exposed to the liabilities of the investment. This is often the best vehicle for a smaller investor in U.S. real estate. The limited liability company provides for the best income tax treatment and limited liability for the investor’s wealth.

3. The Foreign Corporation

As a general rule, it is not a good idea for a foreign investor to use a foreign corporation that will then directly invest in U.S. real estate. This is because foreign corporations that invest in U.S. real estate can be subject not only to U.S. corporate income taxes but might also be subject to a branch tax equal to 30% of the foreign corporate investors’ undistributed U.S. profits.A foreign corporation is, however, very often the investment vehicle of choice for a foreign investor that is investing significant amounts of money in U.S. real estate, such as $1 Million or more. This is because estate tax becomes a major potential liability for substantial fortunes invested in U.S. real estate and U.S. estate taxes may be completely avoided if the individual foreign investor owns a foreign corporation that may in turn own the U.S. real estate.There are no estate taxes in this situation because when the foreign investor dies, the foreign investor has only transferred to his or her heirs’ shares in the foreign corporation and there is no direct interest in U.S. real estate.

4. U.S. Domestic Corporate Ownership

The use of a United States corporation by an individual foreign investor who invests in the United States real estate is very limited by itself. That is because shares of stock in a United States corporation that owns U.S. real estate are also included in the foreign investor’s estate, if the foreign investor dies owning those shares. Thus ownership of a U.S. corporation to own U.S. real estate does not solve any U.S. estate tax problems. It does, however, create an extra tax burden for the foreign investor in United States real estate. That is because there will be an income tax on a United States corporation that earns the income as a tax on the gain for the sale of the real estate asset. Unlike the tax on an individual, which is limited to 15%, this tax can be as high as 35% when earned by a United States corporation. This can also lead to double taxation when dividends are paid to a foreign investor from the United States corporation.There are however, two situations in which investment in United States real estate by the ownership of a United States corporation does make sense. They are as follows:

Gift of Shares

First, if f the foreign investor intends to ultimately make a gift of his shares in a United States company that owns U.S. real estate to third parties, such as family members, etc., there will be no U.S. gift tax asserted on the gift of those shares. There would have been a U.S. gift tax had the real estate been given directly. Thus, the gift tax may be avoided if shares in a United States corporation are transferred prior to the foreign investor’s death. By gifting the shares the original owner will avoid the estate tax.

5. Foreign Corporation and U.S. Corporation.

Another extremely important use of a United States corporation is when it is part of a chain of corporations that ultimately owns the U.S. real estate. For example, if the foreign investor were to establish a foreign corporation that became the 100% owner of a United States corporation that owned United States real estate, the foreign investor will be able to avoid any United States estate tax completely since nothing in the U.S. is transferred in the event of the death of the foreign investor.This method of ownership is often recommended for large investments in United States real estate where the estate tax can become a major issue. It does however involve potential double taxation and other traps and tax benefits that must be individually applied.

Term Life Insurance

There is another alternative to having the best of both worlds, which is to pay United States income taxes as an individual investor or as a limited liability company while not being concerned with the effect of United States estate taxes in the event of a premature death. That alternative is for the foreign investor to acquire sufficient “term life insurance” that pays only a death benefit for the contemplated life of the investment.

As an example, assume an investor invests one-half of One Million Dollars in United States real estate which doubles in value and is worth One Million Dollars upon the foreign investor’s death. Assume a United States estate tax of $350,000 on the value of United States real estate. The value of a $350,000 life insurance policy for say a ten year period only of a relatively young man or woman will not be at all prohibitive from a cost standpoint.3

FOOTNOTES:

- See article “Tax Planning for Foreign Investors Acquiring Larger ($1,000,000 and over) United States Real Estate Investments” for a companion article on Tax Planning for Foreign Investors Acquiring Larger United States Real Estate Investments.

- In addition, several of the individual states in the U.S. charge their own separate income tax on income earned in that state.

- Another estate planning tool that allows a non resident alien investor to invest in United States real estate without incurring U.S. estate tax is the use of a Non Grantor Trust. This is a devise whereby the investor purchases the U.S. real estate using a foreign trust and foreign beneficiaries, such as family members, so that trust will ultimately benefit others. This vehicle is specifically not being discussed in this article since it does involve the investor’s alienation of the property to a trust that is extremely restrictive of any powers that the investor can have over the real estate owned by the Non Grantor Trust.

Richard S, Lehman, Esq.

TAX ATTORNEY

6018 S.W. 18th Street, Suite C-1

Boca Raton, FL 33433

Tel: 561-368-1113

Fax: 561-368-1349

Richard S. Lehman is a graduate of Georgetown Law School and obtained his Master’s degree in taxation from New York University. He has served as a law clerk to the Honorable William M. Fay, U.S. Tax Court and as Senior Attorney, Interpretative Division, Chief Counsel’s Office, Internal Revenue Service, Washington D.C. Mr. Lehman has been practicing in South Florida for more than 35 years. During Mr. Lehman’s career his tax practice has caused him to be involved in an extremely wide array of commercial transactions involving an international and domestic client base.

By Richard S. Lehman, Esq., of Richard S. Lehman P. A.; Boca Raton, FL

In last week’s column, we established that today’s business climate is extremely treacherous for all sizes and types of business. Whether a suit is won or lost, frivolous or legitimate , there are major distractions. Time is spent defending actions, while revenue-generating activities are curtailed. Similarly, large sums of money can be spent on defense.

In the first article, we analyzed a variety of asset protection entities. In this final segment, we will look at protected forms of investment. Business owners, directors of public companies, management and individuals should consider making use of these various methods of investment as another protection against liabilities.

Exemption equals protection.

Not only can there be protection from creditors by choosing the proper entity in which to hold assets, many types of investment assets are also protected from creditors by virtue of state and federal exemptions.All states have “exemptions” to designate categories of property interests that are immune from forced sale or seizure. Florida law provides an assortment of such exemption:

- Annuity and insurance contracts. Florida law protects the cash surrender values of life insurance policies and the proceeds of annuity contracts issued upon the lives of residents of the state. Creditors of the insured or the beneficiary cannot seize the assets unless the policies or contracts were for the benefit of the creditor.

- Life insurance trusts. Consideration of the life insurance trust provides an asset protection opportunity that makes use of the trust concept, the exemption concept and also provides for major estate and gift tax benefits. This type of trust, formed to handle life insurance proceeds, is similar to the domestic trust described in the previous article. Asset protection may be afforded by providing limitations on the beneficiaries’ interest. Under Florida law is also protection from creditors due to the exemption, and it also provides for the estate tax-free payment of life insurance death benefits to beneficiaries.

By placing the policy in a separate irrevocable trust, rather than owning the policy, the insured retains no “incidence of ownership.” The death benefits payable from the policy will not be included in the insured’s estate. If the insured does not use a trust or another person as the owner of the policy and retains any incidence of ownership, all of the death benefits will be subject to estate taxes.

All states have exemptions to designate categories of property interests that are immune from forced sale or seizure. Florida law provides an assortment of such exemptions. Homestead and other exemptions.

- Homestead protection. Florida provides unlimited protection for the homestead property and improvements. The limit on the size of protected property is up to one-half acre in a city or 16 acres in the country.

- Earnings of a head of household. Florida protects compensation for personal services or labor whether denominated as wages, salary, commission or bonus. The first $500 a week of such earnings are absolutely exempt from attachment or garnishment and anything above that amount will not be subject to attachment or garnishment unless such person has agreed otherwise in writing. Wages may be protected for six months after receipt.

- Disability insurance and disability insurance proceeds. Florida exempts disability payments from creditors, including lump sum proceeds resulting from settlement of a claim against a disability carrier.

- Pension plans and IRA’s. These are generally protected, but bankruptcy courts have found that pensions will not be protected from creditors in the event of inappropriate compliance with tax or labor laws. Among common defects that may cause this qualification are a failure to cover all employees requiring such coverage, inappropriate investments and loans, and prohibited transactions.

- Alimony rights. These rights are a protected asset.

- Unemployment compensation benefit rights. As defined by Florida law, these rights are exempt from all claims and creditors.

Keep in mind that these are cursory explanations of several asset protection strategies. Business owners should realize that their assets are always at risk, so it’s worth considering these plans with a professional as a way to protect what you’ve built personally and through your business.

Originally Published: May 31, 2002 in South Florida Business Journal

By Richard S. Lehman, Esq., of Richard S. Lehman P.A.

As times become more and more troubled, South Florida sees more than its share of immigrants fleeing dangers and coming here to stay; and foreign investors who want their money and second homes here. One concern that is often high on their list is the payment of United States Federal taxes, both income taxes and estate taxes. From a tax perspective there are both special advantages and traps for both would-be immigrants to the United States and the foreign investor. This article will look at both the traps and the advantages.

Background Information.

One can best understand these beneficial tax concepts with a short discussion of the general U.S. tax principles that apply to nonresident alien individuals and foreign corporations. There is a vast difference in the manner in which the United States will apply its income, estate and gift taxes to an alien individual or foreign corporation that might be considered a “U.S. resident” for U.S. tax purposes and individuals and foreign companies that are considered “non-resident”, for U.S. tax purposes. A tax resident will be subject to U.S. income taxes, estate taxes and gift taxes on a worldwide basis. Non-residents will generally pay a U.S. income tax only on income earned from U.S. sources and will pay U.S. estate taxes only on real property and certain other assets situated in the United States.

Tax Planning for the Immigrant to the U.S.

Let’s first consider the tax concepts that generally apply to a wealthy person immigrating to the U.S. It is extremely important that any tax planning strategies that need to be adopted to preserve the wealth of an immigrant coming to the United States be completed before the immigrant becomes a United States “resident for tax purposes” or becomes a United States citizen.

Income Tax Strategy

A key strategy for the alien immigrant coming to the United States is to make sure that assets owned by the immigrant that have appreciated value prior to the immigrant obtaining U.S. residency are dealt with so that these gains earned well before U.S. tax residency can be earned (for U.S. tax purposes) while the immigrant is still a non resident alien, not subject to U.S. tax.

An Extreme Example

While we can only scratch the surface here regarding planning for the immigrating alien; it is possible to see just how generous the United States tax laws can be. Let us consider an extreme example of the potential benefits for alien immigrants and long term visitors to the United States. A prime example is the use of the student visa to reside in the U.S. A foreign student who has obtained the proper immigration status will be exempt from being treated as a U.S. resident for U.S. taxes purposes even if he or she is here for a substantial time period that would ordinarily result in the student being taxed as a U.S. resident.

This student visa not only permits the student to study in the United States and pay taxes only on income from U.S. sources not worldwide income. The visa also permits the student’s direct relatives (such as spouse and children), to accompany the student to the United States and receive the same tax benefits. Assume the student, a Columbian woman aged 40, is married to an extremely successful Columbian businessman who accompanies her with their two children to the U.S. His annual income is $1.0 Million and is earned from the banking business in Columbia. He earns no U.S. income. Under those circumstances, for U.S. income tax purposes, this businessman is exempt from U.S. tax on his worldwide income while living full-time in the U.S. for less than five calendar years.

Tax Planning for the Foreigner that Invests in the United States

Many foreigners do not wish to immigrate to the U.S. but do want their money invested here. In these situations, there are also significant advantages to the non resident alien or foreign company that may wish to invest in the United States. In fact, foreign investors within certain limitations, and depending on the nature of their investment, can build a fortune from U.S. income without ever paying: (1) any U.S. income tax on the income or (2) paying any U.S. estate tax on the wealth in the U.S. that produced that income. Again, a few examples can illustrate these principals.

The Foreign Investor - Income Tax Benefits

Mrs. X, a non resident alien, invests in the United States stock market and receives a minor amount of dividend income. Her investments in the U.S. market are growth investments and the shares are held almost exclusively for capital gain. If Mrs. X sold those shares for a profit shortly after purchasing them she would receive a large short term capital gain. There is no U.S. tax on Mrs. X. Except for real estate gains, foreign investors are generally excluded from paying tax on any capital gains earned in the United States.

As another example, the United States must compete in the world market for investment funds and most of the U.S.’s competitors permit foreign investors that invest in the competitor country to earn interest income exempt from paying any taxes to that country. The United States is forced to provide similar exemptions in order to attract capital in the form of loans from foreign investors. This special tax free treatment is accomplished by permitting certain types of loans from foreigners to Americans that result in interest income to be earned free of any Federal income tax. These loans are called Portfolio Interest Loans.

The Foreign Investor - Estate Tax Benefits

Finally, let’s consider how the foreign investor makes sure that he or she does not pay a United States estate tax, even though their investment was an investment in U.S. property at the time the foreign investor passed away. Mrs. A is a non resident alien with a large second home valued in the millions in South Florida, which she only uses periodically on visits to the U.S. If Mrs. A were to die with that Florida home titled in her individual name, her estate would be subject to Federal estate taxes even though she is a foreigner. The U.S. estate tax is asserted on United States real estate owned by a foreign decedent at the time of death. However, if Mrs. A acquires her home in the name of a wholly owned foreign corporation instead of her own name; there would be no U.S. estate tax as a result of her death. This is because on her death she had no direct ownership of any U.S. property. Her beneficiary will receive only the shares of the foreign corporate owner of the home. There can be no U.S. estate tax on a non-resident alien when the decedent alien only transfers shares of a foreign company. As one can see, under the right circumstances, the U.S. may be the best “tax shelter” in the world for non resident aliens, foreign corporations and immigrating aliens.

Richard S. Lehman is a principal in the Boca Raton-based law firm of Richard S. Lehman and Associates, P.A. The firm specializes in tax law, estate and asset protection planning, and international law.

Originally Published: January 16, 2004

South Florida Business Journal

By Richard S. Lehman & Associates Attorneys at Law

The general principles discussed herein are not intended to be legal or tax advice and taxpayers should consult with their individual legal, accounting and tax advisors.

PRE-IMMIGRATION TAX PLANNING

What Can Be Accomplished Prior to Residency Status

South Florida continues to be a destination for legal aliens hoping to invest; do business and live in the United States. Very often immigrating residents are unfamiliar with the tax laws of the United States that they will face upon obtaining their resident status. Often this lack of knowledge can be costly with immigrants paying unnecessary taxes and burdening themselves with liabilities.

The following is a checklist of issues that may be helpful to avoid these tax problems. The checklist does not consider the effect of a tax treaty that may apply to an immigrant.

I. Status for Tax Purposes

- Resident for Income Tax Purposes

a. Green Card

b. Substantial Presence Test

c. Voluntary Election

- Resident for Estate and Gift Tax Purposes

a. Country of Domicile

II. Taxation Pattern

- Resident - Subject to Taxation

a. Income Taxation - Worldwide Income

b. Estate Taxation - Worldwide Assets

c. Gift Taxation - Worldwide Assets

- Non Resident Alien - Subject to Taxation

a. Income Taxation - United States Source Income, Limited type of Foreign Source Income

b. Estate Tax - United States Situs Assets Only

c. Gift Tax - Real and Tangible Personal Property with a United States Situs

- Situs of Assets

a. Real Property in the U.S. - U.S. Situs

b. Tangible Personal Property - Located in the U.S . - U.S. Situs

1. - Cash - Needs Special Consideration

2. - Exceptions for visiting art work

c. Intangible Personal Property - Dependent upon the type of intangible property

III. Pre-Immigration Planning - Income Tax and Gain

- Objective - Minimize United States Gains and Income Tax

a. Key Strategy is to accelerate gains prior to residency so that gains earned while one was a non resident alien are not subject to U.S. tax after residency is obtained. Some examples of acceleration of gain are:

b. Traded securities with unrealized gain may be sold before residency and repurchased with a new cost basis

c. Illiquid assets with unrealized gain may be sold to related parties or third parties and gain realized. Careful planning must be undertaken if one sells and repurchases illiquid assets; especially with related parties.

d. Income expected to be paid after residency should be accelerated where possible and paid prior to residency.

Some examples of acceleration of income are:

1. - Exercise stock options

2. - Accelerate taxable distributionsfrom deferred compensation plans

3. - Accelerate gains on Notes held from installment sales

IV. Pre Immigration Planning - Estate and Gift Tax

- Objective-Minimize United States Estate Tax

a. Key strategy is to minimize assets in one’s estate before obtaining residency status; and where possible to retain some degree of control over assets;

b. Planned gifts to third parties should be made prior to residency;

c. Planned gifts of United States Situs Property

1. - Tangible Property - Physical Change of Situs to a Foreign Situs Before Gift is made;

2. - Real Estate - Contribution to foreign corporation and gift of stock in foreign corporation.

d. Transfers in Trust for Beneficiaries

V. EXCEPTIONAL CIRCUMSTANCES AND SPECIAL TAX BENEFITS

- Students

a. A foreign student who has obtained the proper immigration status will be exempt from being treated as a U.S. resident for U.S. tax purposes even if he or she is here for a substantial time period that would ordinarily result in the student being taxed as a U.S. resident.

b. This student visa not only permits the student to study in the United States and pay taxes only on income from U.S. sources not worldwide income. The visa also permits the student’s direct relatives to accompany the student to the United States and receive the same tax benefits.

c. Assume the student, a Columbian woman aged 40, is married to an extremely successful Columbian businessman who accompanies her with their two children to the U.S. His annual income is $1.0 Million and is earned from the banking business in Columbia. He earns no U.S. income. Under those circumstances, for U.S. income tax purposes, this businessman is exempt from U.S. tax on his worldwide income while living full-time in the U.S. for less than five calendar years.

- Treaty Benefits

Aliens that are governed by a tax treaty can generally spend more time in the U.S. than an alien not covered by a treaty before being considered a resident alien for tax purposes.

The web sites below have been created by Lehman Tax Law to help you better understand your options. Since tax law is ever evolving — the site content will evolve and provide detailed advice. The following sites are current and up-to-date.

![]() United States Taxation of Foreign Investors: http://www.unitedstatestaxation.com

United States Taxation of Foreign Investors: http://www.unitedstatestaxation.com

This web site is intended to provide the foreign investor with only a basic introduction to the tax laws of the United States as they apply to that foreign investor.

The narrative outline available from this site is available in 8 languages:

English, French, Spanish, German, Italian, Arabic, Chinese, and Russian

Ponzi Scheme Tax Loss:

www.ponzischemetaxloss.com

This web site offers tax recovery advice for victims of Ponzi Schemes. Includes a Free 50-minute web seminar: For victims of Ponzi Schemes and financial professionals. Learn how recovery through the “Tax Refund” is quick and reliable.

- How to best secure a tax refund from Ponzi Scheme losses

- How the government has made recovery easier

- What you need to know about theft losses

- How to plan and implement a taxpayer Ponzi Scheme tax loss for maximum benefits now, and in the future.

IRS Voluntary Compliance for Offshore Banking: ![]() www.offshorebankingamnesty.com

www.offshorebankingamnesty.com

On March 23, the Internal Revenue Service came up with a six month “Amnesty Program” to allow U.S. taxpayers with unreported income to disclose their foreign bank accounts without fear of any criminal tax penalties. That was then — and this is now - Mr. Lehman has found on multiple occasions that when dealing with cases such as those involved in the Amnesty Program, the taxpayer is best served by making his first few steps the right ones which include hiring the right team of counsels that include both a tax lawyer and a criminal lawyer.

Richard S. Lehman, P.A.

2600 N. Military Trail, Suite 270, Boca Raton, Florida 33431

Tel: (561) 368-1113 | Fax: (561) 998-9557