Posts Tagged ‘richard s lehman’

The Export Disc Corporation Computer Software And Internet Sales And Licenses

By Richard S. Lehman, Esq

The IC-DISC has been approved as an acceptable tax planning entity for the export of American produced computer software and programs as early as 1985. In 1998, a very detailed set of Treasury Regulations were issued that have added certainty to this area of the law.

Before the issuance of the Software Regulations, there was uncertainty about the taxation of computer program transactions. Computer programs did not fit traditional tax principles. Computer programs are usually sold pursuant to “license” or “user agreements”. A computer program transaction is unlike a sale of a physical object since the value of the program copy far exceeds the value of the physical medium on which it is transferred. Computer programs, in fact are transferred electronically. Often, there is no physical medium at all.

For purposes of determining the applicability of the DISC to computer software exports, two key analyses are often required. First, (1) is the software “export property” for DISC purposes and (2) is the software product’s source of income “from without the U.S.”? Is the product for use, consumption or sale without the U.S.?

In a technical advice memorandum in 1985, the I.R.S. issued guidance on the issue of whether certain computer software programs constituted “export property” for DISC purposes. That Technical Advice Memorandum reviewed the term “export property” for DISC purposes in depth and determined in its holding that computer software could indeed be “export property”. In doing so the Technical Advice not only reviewed the legislative history of the DISC rules it also pointed out the distinctively different treatment that “patents, inventions, models, decisions, formulas, or processes whether or not patented, copyrights, goodwill, trademarks, trade brands, franchise or other like property” receive under the DISC rules, as opposed to the treatment of “films, tapes, records or similar reproductions, for commercial or home use.”

Copyright law is the basis for the Software Regulations. The Regulations are based on the concept that it is possible to categorize a computer program transaction by analyzing the copyright rights transferred. Like many other tax laws, it is generally accepted that the taxation of payments made pursuant to a contract is determined based on an analysis of the contract’s substance, without regard to the labels.

The most important distinction created by the Software Regulations is the distinction between copyrighted articles and copyright rights. This basic distinction arises from copyright law. Copyright law distinguishes between the copyright itself, which grants the owner certain rights, and a copy of the copyrighted work. The Copyright Act grants to copyright owners the exclusive right to “reproduce the copyrighted work in copies”. The Copyright Act states that “Ownership of a copyright, or of any of the exclusive rights under a copyright, is distinct from ownership of any material object in which the work is embedded.”

The Copyright Rights are not “export property” for DISC purposes while the Copyright Articles are “export property”.

The “Export Property” analysis in the I.R.S. Technical Advice Memorandum is enlightening.

The computer software considered as an example to show the nature of “Computer Articles” was described in the Technical Advice Memorandum as follows:

Mr. X develops, markets and services standardized computer software on a worldwide basis. The software consists of computer programs on magnetic tape. Computer programs are coded instructions to operate the computer to process data in a specified manner.

Mr. X’s computer software products are manufactured in the following manner. Computer programmers develop a computer program, which is referred to as “source language software” (“source code”). The source code is highly confidential and kept under strictly controlled security at all times. The modifications to the computer programs that are required to keep the software up to date with changing technology and user requirements are made to the source code. The source code is processed by a computer into a master recording, which contains the magnetic impulses a customer will receive. Unlike the source code, the master recording cannot be used to modify a software program. The products that Mr. X markets are tapes made from the master recordings.

The Export Property Analysis

Export property is defined to mean, in general, property that is:

- Manufactured, produced, grown or extracted in the United States by a person other than a DISC,

- Held primarily for sale, lease, or rental, in the ordinary course of trade or business, by, or to, a DISC, for direct use, consumption, or disposition outside the United States and

- Not more than 50 percent of the fair market value of which is attributable to articles imported into the United States.

Export property does not include “patents, inventions, models, designs, formulas, or processes, whether or not patented, copyrights (other than films, tapes, records, or similar reproductions, for commercial or home use), good will, trademarks, trade brands, franchises, or other like property . . .

Although a copyright such as a copyright on a book does not constitute export property, a copyrighted article (such as a book) if not accompanied by a right to reproduce it is export property. The legislative history of the DISC states the following: “Although generally the sale or license of a copyright does not produce qualified export receipts (since a copyright is generally not export property), the sale or lease of a copyrighted book, record, or to her articles does generally produce qualified export receipts”.

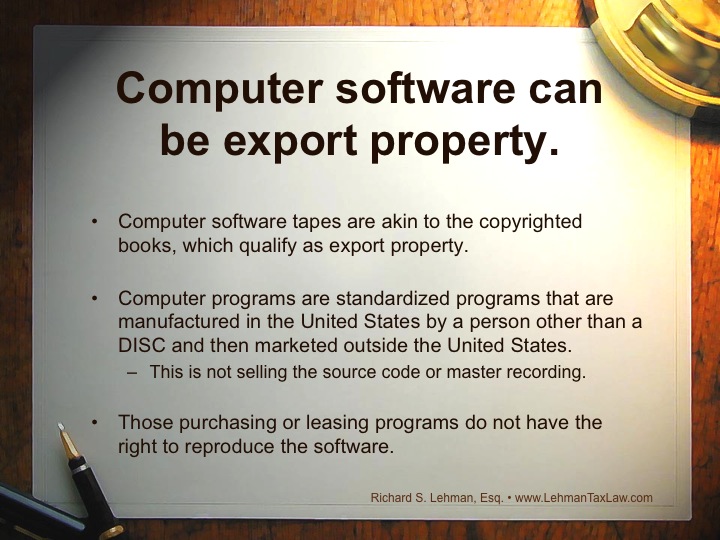

Computer software can be export property. Computer software tapes are akin to the copyrighted books, which qualify as export property. Computer programs are standardized programs that are manufactured in the United States by a person other than a DISC and then marketed outside the United States. This is not selling the source code or master recording. Those purchasing or leasing programs do not have the right to reproduce the software.

Copyright Rights

The regulations distinguish between transfers of copyright rights and transfers of copyrighted articles based on the type of rights transferred to the transferee. The transfer is classified as a transfer of a copyright if, as a result of a transaction, a person acquires any one or more of the following rights:

(1) the right to make copies of the computer program for purposes of distribution to the public by sale or other transfer of ownership, or by rental, lease or lending;

(2) the right to prepare derivative computer programs based on the copyrighted computer program;

(3) the right to make a public performance of the computer program; or

(4) the right to publicly display the computer program.

Transfers of Computer Programs

The regulations provide rules for classifying transactions involving the transfer of computer programs. A computer program includes any media, user manuals, documentation, database or similar item if the media user manuals, documentation, database or similar item is incidental to the operation of the computer program.

A copyrighted article is defined as a copy of a computer program from which the work can be perceived, reproduced, or otherwise communicated, either directly or with the aid of a machine or device. If a person acquires a copy of a computer program but does not acquire any of the four copyright rights, the transfer is classified as a transfer of a copyrighted article.

In general, a transfer of a computer program is classified in one of the following ways.

- A sale or exchange of the legal rights constituting a copyright (which generates income sourced according to the rules for sales of personal property);

- A license of a copyright (which generates royalty income);

- A sale or exchange of a copyright article produced under a copyright (which generates income sourced according to the rules for sales of personal property);

- A lease of a copyright article produced under a copyright (which generates rental income).1

1Additional rules allow for the classification of a transfer as partially a transfer of services or of know-how. The provision of know-how, in which the transferor retains continuing use of the know how transferred, is presumably most like a license of a copyright.

The following are four examples from the Treasury Regulations that describe the four types of transactions.

Example 1 – Sale of Copyright Article

A U.S. corporation, (the “U.S. corporation”) owns the copyright in a computer program, (the “Program”).

The U.S. corporation, (the “U.S. Corporation”), makes the Program available, for a fee, on a World Wide Web home page on the Internet. Mr. P, a resident of Country Z, in return for payment to the U.S. Corporation, downloads the Program X (via modem) onto the hard drive of his computer. As part of the electronic communications, P signifies his assent to a license agreement.

Mr. P receives the right to use the program on his own computers (for example, a laptop and a desktop). None of the copyright rights have been transferred in this transaction. P has received a copy of the Program. P has acquired solely a copyrighted article.

P is properly treated as the owner of a copyrighted article. There has been a sale of a copyrighted article rather than the grant of a lease.

Example 2

The facts are the same as those in Example 1, except that the U.S. Corporation only allows Mr. P, the right to use the Program for one week. If P wishes to use the Program for a further period he must enter into a new agreement to use the program for an additional charge.

P is not properly treated as the owner of a copyrighted article. There has been a lease of a copyrighted article rather than a sale.

Example 3

A U.S. Corporation, transfers a disk containing the Program to a Foreign Corporation (the “Foreign Corporation”) and grants the Foreign Corporation an exclusive license for the remaining term of the copyright to copy and distribute an unlimited number of copies of the Program in the geographic area of the Country in which the Foreign Corporation makes public performances of the Program and publicly displays the Program.

Applying the all substantial rights test, the U.S. Corporation will be treated as having sold copyright rights to the Foreign Corporation. The Foreign Corporation has acquired all of the copyright rights in the Program and has received the right to use them exclusively within the Foreign Country.

Example 4

A U.S. corporation, transfers a disk containing the Program to a Foreign Corporation in Country X and grants the Foreign Corporation the non exclusive right to reproduce (either directly or by contracting with another person to do so) and distribute for sale to the public an unlimited number of disks at its factory in return for a payment related to the number of disks copied and sold. The term of the agreement is two years, which is less than the remaining life of the copyright.

There is a lease of copyright rights since copyright right have been assigned but for a limited time period only.

The Source of Income Analysis

Once it is determined that a computer program is a copyright article and thus “export property” for DISC purposes; then the issue is to determine whether the Software Program is being sold for use, consumption of disposition outside of the U.S. This analysis depends upon the “source of income” rules.

Generally under the current rules, the source of income from sales of property depends to varying extents upon both the type of property and whether the property sold or leased is “inventory property”.

Income from the lease of a copyright article must also fit this definition of non U.S. source of income.

The user of the computer program is particularly important in the international context. Income earned from commerce between countries must be assigned a source under rules. This requires a determination of whether the transaction is a sale of inventory, a rental of property, a license or sale of intellectual property or the provision of services.

The regulations focus on (i) acknowledging the special circumstances of computer programs, (ii) distinguishing between transactions in copyright rights and in copyrighted articles, and (iii) focusing on the economic substance of the transaction over the labels applied, the form and the delivery mechanism.

The Software Regulations provide explicit guidance on how to source income arising from transactions categorized under the regulations by cross referencing existing source rules.

The regulations provide that income from transactions that are classified as sales or exchanges of copyrighted articles will be sourced under the sections of Internal Revenue Code that determine if income is earned in the United States for tax purposes or earned outside of the United States. Income from the leasing of a computer program will be sourced under different Internal Revenue Code sections.

Source of Income for Sales of Copyrighted Articles

A transfer of intangible property is a sale if the actual facts and circumstances support the fact that the transferor has transferred “all substantial rights” to the computer software property. A perpetual and exclusive license of intangible property is considered to be a transfer of “all substantial rights” is also treated as a sale, rather than as a license, for tax purposes. All the facts and circumstances are reviewed to determine whether the transaction transferred “all substantial rights” to the property in question.

A sale of a copyrighted article occurs if sufficient benefits and burdens of ownership have been transferred to the buyer, taking into account all facts and circumstances. This is the same test that generally is applied to determine whether transfers of tangible personal property are sales or leases.

The source of income generated by the sale or exchange of a copyrighted article often depends upon whether the sale took place within or without the United States. The Software Regulations provide that the place of sale is determined under the “title passage rule”.

The governing regulation state that “a sale of personal property is consummated at the time when and the place where, the rights, title and interest of the seller in the property are transferred to the buyer”. The sale shall be deemed to have occurred at the time and place of passage to the buyer of beneficial ownership and the risk of loss.

As to the issue of determining the place of sale under the title passage rule, the parties in many cases can agree on where title passes for sales of inventory property generally.

Application of the Title Passage Rule

As described above, the source of income generated by the sale or exchange of a copyrighted article often depends upon whether the sale took place within or without the United States. The place of sale is determined under the title passage rule. The Software Regulations recognizes that typical license agreements do not refer to a transfer of property and an electronic transfer is generally not accompanied by the usual indicia of the transfer of title.

Application of the Title Passage Rule

There are important categories of copyrighted article transfers for DISC purposes: (i) a transfer of tangible property, such as a tangible medium in which the copyrighted article is embodied, and/or a hard copy of user manuals and documentation; (ii) (e.g., electronically transmitted copyrighted articles without any hard copy of user manuals and documentation). Either one of these can be the subject of a sale.

To comply with the passage of title rules, a DISC may consider language such as: Title to this computer software program, shall pass outside the United States in its agreements when tangible property is being transferred. If non tangible property is delivered, the DISC taxpayers could consider documentation for foreign users (which could be a contract to sign or terms consented to electronically) that states that the vendor’s delivery obligation shall be complete and risk of loss with respect to the copyrighted article shall pass at the time the program is copied onto the recipient’s computer at the end user’s location.

Partial Transfer of a Copyright Article: A Lease

If less than all of the benefits and burdens associated with a copyrighted article have passed to the transferee, the Software Regulations treat the transaction as a lease. Copyright articles can be leased as well as sold. Computer programs do not involve the risk of physical deterioration or physical destruction but they do have the risk of technological obsolescence. If this risk is assumed by the transferee, generally through a transaction in which the transferee makes a single payment in return for the right to use the program copy in perpetuity, then the transferee has assumed the risk of obsolescence and should be treated as the owner of the program copy.

However, if the transferee instead makes periodic payment and can cease its use of the program when it chooses, then the transferee has not assumed the relevant benefits and burdens of ownership and the transaction should be considered a lease.

Lease and Rental Source of Income

Under the Software Regulations, income derived from the rental of a copyrighted article is sourced under Section 861(a)(4) and 862(a)(4). As a general rule, rents and royalties are sourced to the place where the leased or licensed property is located, or where the lessee or licensee uses, or is entitled to use the property.

Leased property is used where it is physically located at the time of its use by the lessee. Therefore a computer program copy that is “rented” under a limited duration license should be considered to be used at the place where the computer that hosts the program is physically located while the lessee uses the program. If the copy resides on the lessee’s computer, the lessor will need to know where that computer is located in order to source its rental income.

If you have additional questions, please contact us today. Value can be lost without good legal advice.

THE IC-DISC

By Richard S. Lehman, Esq

(PLEASE NOTE: The IC-DISC topic is available as a free online seminar presented by Mr. Lehman)

The business world is going to be a tough place for the American exporter in 2013. The dollar will remain strong, keeping U.S. goods high priced, trade to the Euro zone will weaken while the cheap euro makes the Euro Zone highly competitive as exporters. China will contract and desperate competitors and countries will be trying even harder to protect their own. With export profits hard to come by, U.S. taxpayers that sell, lease or license “export property” which is manufactured, produced or grown in the United States (not more than 50% of which attributable to U.S. imports), can take advantage of strong support for their export profits in the Internal Revenue Code.

Export profits can produce substantial tax benefits with little more than establishing a new corporation dedicated almost exclusively to export profits; a separate set of export books and records, and abiding by a relatively simple set of rules that govern Domestic International Sales Corporations (now known as “IC-DISC). Rather than being organized as a mere “paper” entity for receipt of commission income only, an IC-DISC can have more substance and engage in additional export-related activities such as promotional activities, thereby enhancing its income and the benefit of the advantageous tax rates to shareholders.1/

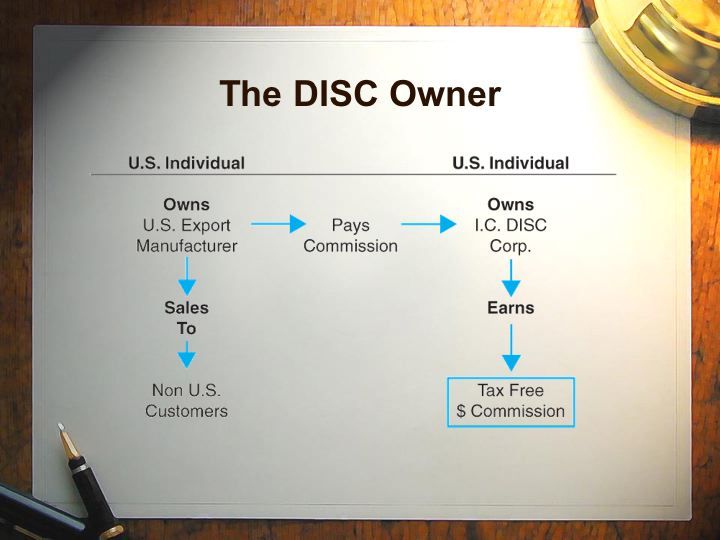

An IC-Disc is compensated by a U.S. taxpayer that manufactures, sells or licenses “export property”. Typically the U.S. taxpayer that establishes the IC-DISC will be related to the IC-DISC and even own the IC-DISC. The U.S. taxpayer agrees to pay the IC-DISC based on a Commission Agreement. A portion of the U.S. taxpayer’s export profits are paid to the IC-DISC and the payment is deducted from the profits of the U.S. manufacturer, seller or licensor. The portion of the U.S. taxpayer’s “export profits” that are paid to the IC DISC are measured under three profit scenarios. The deduction may exceed more than 50% of the U.S. Taxpayers’ export profits, depending upon gross income, profitability and costs.

In its simplest terms, the IC-DISC is a separate corporation. The income received by the DISC is not taxable to the DISC. The DISC is charged with accounting separately for a U.S. “taxpayer’s export profits” and receives more than 50% of the export profits free of any U.S. taxation.2/

The existence of the DISC will be transparent to the export company’s customers. The exporter will continue to operate its business in the same manner and its employees will continue to perform the company’s manufacturing, sales, billing, shipping and collection functions. The fact that there is a commission agreement between the exporter and the DISC will not have to be disclosed to the exporter’s customers and no documentation provided to the customers will need to indicate the existence of, or services deemed provided by the DISC.

Architects and engineers may also be surprised to learn that their services can also qualify of DISC benefits for construction projects located outside of the U.S. if professional services related to those projects can be performed in the United States.

What are the IC-DISC rules that need to be obeyed?

IC-DISC Rules

The IC-DISC must sell, lease, license or service “export property”

Export property means property:

Manufactured, produced, grown or extracted in the United States; held for sale, lease or rental, in the ordinary course of business, for use, consumption or disposition outside the United States; and Not more than 50% of the fair market value of which is attributed to articles imported into the United States.

Services Furnished by DISC

Services can also be provided by the I.C. DISC if such services are provided by the person who sold or leased the export property to which such services are related. The DISC acts as a commission agent with respect to the sale or lease of such property and with respect to such services that cannot exceed a certain amount of the value of the transaction. The service must be of the type of customarily and usually furnished with the type of transaction in the trade or business in which such sale or lease arose.

IC-DISC REQUIREMENTS

- A corporation taxable as a corporation, must be formed under the laws of any State or the District of Columbia to be the IC-DISC

- The corporation must have only one class of stock and minimum capital of $2,500. The IC-DISC shareholders may be related to the IC-DISC.

- The IC-DISC must take a tax election to be an IC-DISC that must be filed with the Internal Revenue Service within 90 days after the beginning of the tax year of the IC-DISC.

- The IC-DISC must maintain separate books and records.

- The IC-DISC must have at least 95% or more of its gross receipts considered to be Qualified Receipts resulting from the DISC’s export activities.Qualified export receipts of a DISC include gross receipts from the sale of export property by such DISC, or by any principal for whom the DISC acts as a commission agent. The transaction must be pursuant to the terms of a contract entered into with a purchaser by the DISC or by the principal at any time or by any other person and assigned to the DISC or the principal at any time prior to the shipment of such property to the purchaser. Any agreement, oral or written, which constitutes a contract at law, satisfies the contractual requirement of this paragraph.Qualified export receipts of a DISC include gross receipts from the lease of export property provided that the property is held by a DISC (or by a principal for whom the DISC acts as commission agent with respect to the lease) as an owner or lessee at the beginning of the term of such lease and entered into with the DISC for the DISC’S taxable year in which the term of such lease began.

- The IC-DISC must have at least 95% or more of its assets considered to be Qualified Export Receipts. For a corporation to qualify as a DISC, at the close if its taxable year it must have qualified export assets with an adjusted bases equal to at least 95 percent of the sum of the adjusted bases of all its assets. A qualified export asset held by a DISC is an export property that is a business asset used in the export business, export trade receivables, temporary export investments and several loans that can result from engaging in export financing techniques.

Essentially, as a practical matter, this means all IC-DISC gross receipts should be devoted almost totally to the IC-DISC operation. There is no reason to violate either of these formulas. However, there is no requirement that the IC-DISC be an actual operating company except the corporate form must be respected in all regards as with any other corporation.

“Thus the magic of the IC-DISC is to provide both tax deferral and to apply a 15% maximum dividend tax rate to profits that would otherwise be taxable in the U.S. taxpayer’s highest brackets that can range as high as 50% when city, state and federal income taxes are calculated.”

The Tax Benefits

The benefits of the IC-DISC come in two separate fashions. The IC-DISC shareholders may leave the IC-DISC profits in the IC-DISC and defer taxation until actual distribution of the profits or the IC-DISC may distribute profits to its shareholders like any other corporation. Since IC-DISC distributions are considered “qualified dividends” they are subject to a maximum tax of 15%. Thus the magic of the IC-DISC is to provide both tax deferral and to apply a 15% maximum dividend tax rate to profits that would otherwise be taxable in the U.S. taxpayer’s highest brackets that can range as high as 50% when city, state and federal income taxes are calculated.2/

Typically the IC-DISC is established, by a related company that is engaged in a United States business that includes gross revenues from both domestic and international sources. The related company’s principals will be the direct or indirect owners of the IC-DISC that may be owned directly or any transparent entity, that may be a partnership, or a disregarded entity, such as a one person limited liability company.

For the maximum tax advantage the IC-DISC shareholders should avoid double taxation by acting as individual shareholders or using disregarded entities and/or pass through entities. The IC-DISC corporation itself must be a c corporation and may not elect Sub chapter S status.

Tax Deferral

There is a cost to take advantage of the tax deferral tax benefit available using an IC-DISC. However, in today’s climate and for the foreseeable future, the cost is minimal. The IC-DISC rules provide that an “interest charge” must be calculated on IC-DISC distributions that are not paid as taxable dividends in the year earned. However, that interest charge is the same as the rates charged on one year Treasury bills that have been ranging at less than 1% per annum. Thus at this time a U.S. Taxpayer may defer the U.S. income tax on 50% or more of its export profits at a cost of less than 1% per year and then eventually distribute those export profits and their tax free earnings at the 15% U.S. dividend rate.

Major Savings

However, it is extremely important that U.S. taxpayers not be misled by the $10,000,000 annual cap on tax free income that is permitted by an IC-DISC. This $10. Million annual cap does not require the DISC pay taxes on its income of IC-DISC profits over $10.0 Million. The DISC remains tax exempt. This means that IC-DISC profits in excess of $10 Million annually will be immediately taxed to the shareholders as a DISC dividend.

Profits in excess of the $10.0 Million maximum are considered automatically annual dividends from the DISC with no deferral privileges. However, while the deferral privileges does not exist, most practitioners believe that the IC-DISC shareholders still will receive the 15% tax rate on the DISC dividends in excess of $10 Million.

The Commission Payments

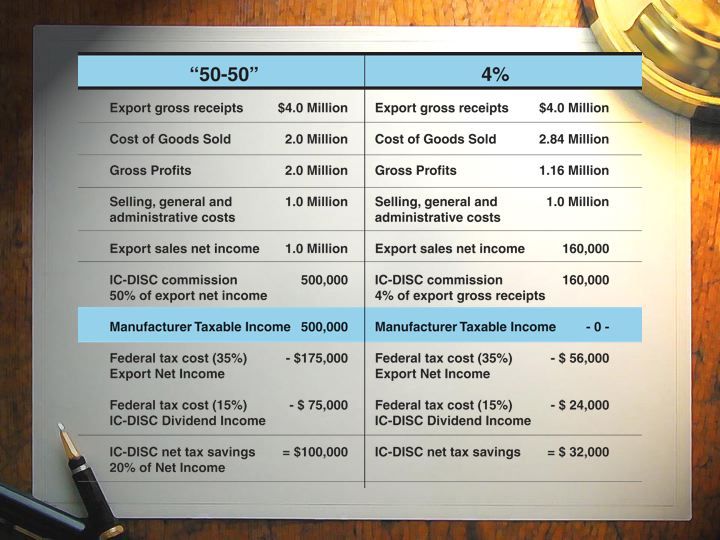

The commission payments will depend upon the pricing methodology chosen by a DISC to record its share of commission income at the greater of any of the following three pricing arrangements:

Gross Receipts Method

Under the gross receipts method of pricing, the transfer price for a sale by the related supplier to the DISC is the price as a result of which the taxable income derived by the DISC from the sale will not exceed the sum of (i) 4 percent of the qualified export receipts of the DISC derived from the sale of the export property and (ii) 10 percent of the export promotion expenses of the DISC attributable to such qualified export receipts.

Taxable Income Method

Under the combined taxable income method of pricing, the transfer price for a sale by the related supplier to the DISC is the price as a result of which the taxable income derived by the DISC from the sale will not exceed the sum of (i) 50 percent of the combined taxable income of the DISC and its related supplier attributable to the qualified export receipts from such sale and (ii) 10 percent of the export promotion expenses of the DISC attributable to such qualified export receipts.

“Export promotion expenses” means those expenses incurred to advance the distribution or sale of export property for use, consumption, or distributions outside of the United States but does not include income taxes.

Arm’s Length Method

If the rules of the preceding paragraphs are inapplicable to a sale or a taxpayer does not choose to use them, the transfer price for a sale by the related supplier to the DISC is to be determined on the basis of the sale price actually charged but subject to the rules provided by the rules of sales between related parties.

Payment

The amount of a transfer price (or reasonable estimate thereof) actually charged by a related supplier to a DISC, or a sales commission (or reasonable estimate thereof) actually charged by a DISC to a related supplier, must be paid no later than 60 days following the close of the taxable year of the DISC during which the transaction occurred.

Examples

The following are examples of the 4% Percent Gross Receipts and “50-50″ Combined Taxable Income Methods of Pricing. Neither example includes any export promotion expenses.

ARTICLE REFERENCES:

- As will be explained later, the “IC” stands for an “interest charge”. This is a cost to be paid to the extent the Domestic International Sales Corporation does not distribute its profits to its shareholders.

- IC-DISC income is also typically exempt from individual state income taxes.

ABOUT THE AUTHOR:

Richard S. Lehman, Esq., is a graduate of Georgetown Law School and obtained his Master’s degree in taxation from New York University.

He has served as a law clerk to the Honorable William M. Fay, U.S. Tax Court and as Senior Attorney, Interpretative Division, Chief Counsel’s Office, Internal Revenue Service, Washington D.C.

Mr. Lehman has been practicing in South Florida for more than 37 years. During Mr. Lehman’s career his tax practice has caused him to be involved in an extremely wide array of commercial transactions involving an international and domestic client base. He has served clients from over 50 countries.

If you have additional questions - please fill out the form below.

To Members of the Bar and other Professionals.

In this ever expanding global world; consider Richard S. Lehman, Esq., and LehmanTaxLaw.com as your in-house international tax law office. Don’t lose clients because you cannot supply the “tax law” piece of the puzzle. Lehman Tax Law has mastered the art of providing international tax advice by internet and will travel where warranted. Arrangements can be made for simultaneous translations and speedy delivery of translated documents in 10 languages to best help service your client.

Mr. Lehman understands professionals are now frequently dealing with alien individuals or foreign corporations investing in, doing business in, or moving to the United States; and/or Americans investing and doing business outside of the United States, or emigrating from the United States. This means that more and more professionals are going to deal with the U.S. tax laws and the world.

The best rule to follow in the field of tax law is to plan legal matters and obtain precision advice in advance to insure commercial endeavors are completed at minimum tax costs and personal lives are minimally disrupted. This is even more the case in the international field.

Mr. Lehman has been around long enough and experienced enough to know that the world of commerce is far from a perfect world. He knows how to apply his knowledge, experience and relationships just as effectively to resolve the unplanned and unexpected legal obstructions that arise in transactions that often lead to failure if not dealt with correctly. It is important to know – Mr. Lehman is just as good in cleaning up the legal mess of others – as making sure a legal mess does not happen in the first place.

For 37 years Richard S. Lehman has been a resource of knowledge in the area of United States taxation. After graduating Georgetown Law School, the New York University Law School Masters program in Taxation and serving as a law clerk on the U.S. Tax Court and with the Chief Counsel’s Office in the Internal Revenue Service in Washington D.C., Lehman has practiced U.S. tax law for 37 years with an emphasis on its international aspects. He has served clients from over 50 countries.

Please contact Mr. Lehman if you require his tax law expertise.

July 2013 Update

The taxation of the Clawback in Ponzi Schemes and certain other financial theft losses.

Now that the Ponzi Schemes, after Madoff have started to mature, they have become more numerous and trustees are clawing back billions from innocent investors who may have profited from their investment in the fraud. The largest recovery for people who must pay Clawbacks, will be from tax refunds. A taxpayer in California or New York City might receive more than 50% of their money back just in tax losses.

We are working on a new seminar “Realizing the maximum value in losses suffered from Ponzi Scheme Claw Back payments”

This online seminar will include a presentation from a seasoned litigation attorney with extremely good credentials who will explain the nature of the Clawback in Ponzi Scheme frauds from a litigator’s standpoint.

This will be of great help to this new class of victims who are targets of a Clawback and do not know where to turn for help.

If you would like to be alerted when this seminar becomes available - please “like” us on Facebook. Or fill out the form on the bottom of the page.

REPORT TO CONGRESS:

- The U.S. Government Accountability Office (GAO) report on the Customer Outcomes in the Madoff Liquidation Proceeding. Download full 80-page report .

New IRS RULING:

http://www.irs.treas.gov/uac/FAQs-Related-to-Ponzi-Scenarios-for-Clawback-Treatment

- The most recent Internal Revenue Service ruling allows clawback victims of Ponzi schemes to maximize their tax refunds and deduct their losses in years that would otherwise be closed by the Statute of Limitations. This is in the event the deductions are more valuable in the earlier years for purposes of tax refunds. The article below describes completely the advantages of how to make use of Code Section 1341.

By Richard S. Lehman, Esq.

(download this article as a .pdf)

Most of us are familiar with the concept of the Ponzi Scheme. An investment built on phony profits that crashes and burns, financially devastating many.

What is less familiar is the fact that an investor in a Ponzi Scheme cannot only lose all of their investment. Investors in Ponzi Schemes can also be forced to pay back additional moneys earned from the Ponzi Scheme years before it exploded. This is what is known as a clawback.

As the baby boomers age, the fear grows that they will outlive their remaining financial resources. After an internet bust, a real estate bust, a Wall Street giveaway, a worldwide recession and banks now borrowing money at less than one percent while the boomers are paying 25% on their credit cards, the boomers are now prime targets for Ponzi Schemes. Multibillion dollar Ponzi Scheme failures are announced with regularity and the list will grow.

With the entire group of baby boomers seeking alternative investments to make sure they are secure, financial frauds, especially Ponzi Schemes will surely grow as the baby boomers reach their peak. Over 70 million people will be looking for the same high rates that will not exist. The term “clawback” will become more familiar as those Ponzi Schemes self destruct.

The definition of a Ponzi Scheme is provided by the I.R.S. and the legal principles governing such a scheme are found at Rev. Proc. 2009-20 at Section 4.01 and Rev. Rul. 2009-9. The I.R.S. calls a Ponzi Scheme a Specified Fraudulent Arrangement.

Specified fraudulent arrangement. A specified fraudulent arrangement is an arrangement in which a party (the lead figure) receives cash or property from investors; (ii) purports to earn income for the investors; (iii) reports income amounts to the investors that are partially or wholly fictitious; (iv) makes payments, if any, of purported income or principal to some investors from amounts that other investors invested in the fraudulent arrangement; and (v) appropriates some or all of the investors’ cash or property.

A Ponzi Scheme will by its very nature reward certain innocent investors to prove the scheme works; and ultimately crash on those investors that left their funds in the scheme to keep earning the large returns or new investors who came in just before the crash. Certain investors will receive their principal and outsized profits while some lose it all.

Once the Ponzi Scheme crashes, there are insufficient funds to meet the obligations and a Trustee is appointed for the Estate of the perpetrators of the Ponzi Scheme. The Trustee is in fact the continuing entity of the perpetrators. However, this Trustee has very broad powers to recoup funds for the general estate so that the Trustee can provide equity among the investors who all have been in the same investment but some have lost while others have won. This is the clawback.

Clawback is a term used to describe the power that a trustee has to regain assets of a debtor that should have been available as part of the bankruptcy estate, but were removed or hidden from the Trustee by the debtor by means of preferential or fraudulent transfers.

The Bankruptcy Code authorizes the trustee to reach back 2 years to recover fraudulent conveyances. There are two general types of fraudulent conveyances (a) a transfer made with actual intent to hinder, delay or defraud creditors (i.e. an actual fraudulent transfer) and (b) a transfer made for less than reasonably equivalent value or fair consideration by an entity that is insolvent or undercapitalized (i.e. a constructive fraudulent transfer).

The Trustee has varying powers in this situation to recoup funds. Without explaining these laws in detail, suffice it to say, the Trustee may recoup profits earned by an innocent investor in a Ponzi Scheme. The Statutes governing this case are very much like strict liability where the innocent investor, (the “Taxpayer”), does not need any wrong intention to be liable. There is liability imposed on the innocent Taxpayer because the Ponzi Scheme perpetrator and not the defrauded Taxpayer ran a Ponzi Scheme. Nevertheless, the Taxpayer was paid from the scheme and can be liable for the return of profits and principal.

As an example, assume Mr. Jones invested $1.0 Million in a Ponzi Scheme and earned $1,500,000 in securities income. The income was distributed to Mr. Jones and Mr. Jones paid tax on the income. The balance of the income was spent by Mr. Jones. Assume the Ponzi Scheme collapses with Mr. Jones holding a balance in his account of $1.0 Million that is lost. Since Mr. Jones’ cash out exceeded his cash in, he may be forced to repay certain income to the Trustee, in spite of his $1.0 Million loss of principal.

The Tax Law

When this “clawback” occurs, generally the income clawed back from the Taxpayer will be deductible by the Taxpayer in the year it is paid. However, often the deduction in the year the clawback is paid may occur at a much lower tax bracket than the tax bracket that was applicable to the income when it was included in income.

To provide for tax equity under specific circumstances, the Internal Revenue Code permits a taxpayer who includes an item in gross income in one tax year and pays tax on that item and who is compelled to return the item in a subsequent year, to calculate the deduction on the amount that is returned in a unique way. This is known as the “Mitigation” section and is found in Section 1341 of the Internal Revenue Code. (the “Code”). The Mitigation provision permits a Taxpayer to calculate the refunded money either as a deduction in the year the refund is paid or a higher tax rate in the year that the refunded sum may have been included in income.

The answer to whether a Taxpayer may recover under the Mitigation Section starts with the legal principle known as the “claim of right doctrine”. It was enunciated in 1932 by the Supreme Court and stands for the proposition that income received in a particular year is subject to tax when received even though it may be returned in a later year.

If a taxpayer receives earnings under a claim of right and without restriction as to its disposition, he has received income [on] which he is required to [pay tax], even though it may still be claimed that he is not entitled to retain the money, and even though he may still be adjudged liable to restore its equivalent.

The Mitigation provision was needed to cure the inequities caused by this rule. Since the passage of the Mitigation provision, several judicial doctrines have evolved and controversies still exist in interpreting the Mitigation section. Some of these have lasted for over 50 years. There are still different judicial views of certain of the requirements that needed to be met to enjoy the benefits of Code Section 1341.

The case of Pennzoil, Quaker State, that was first decided in the Taxpayer’s favor by the Federal Court of Claims in 2004 and later reversed by the Federal Court of Appeals in 2008 clarified matters in this area of the law a great deal but also, to some extent continued the controversy. Together, the two courts defined the five separate requirements that must be met to enjoy the benefits of the Mitigation section and the judicial doctrines that have developed to clarify the law. The two analyses by these courts are helpful in better understanding this Mitigation section. The two courts together explored each requirement of the section thoroughly.

The Requirements of § 1341(a)

A clawback may require both a repayment of the Taxpayer’s previously taxed income earned from the Ponzi Scheme and can also require a repayment of a Taxpayer’s principal investment.1/

The courts in the Pennzoil case considered the availability of Code Section 1341 to a situation where the Pennzoil Company refunded certain amounts of money to independent crude oil producers for alleged price fixing.

Pennzoil ultimately settled the lawsuit for $4.4 Million which it tried to deduct in the prior years when the crude oil was sold instead of the year of payment. Because of the particular facts of Pennzoil, the court in Pennzoil had to deeply analyze each one of the first four requirements of Code Section 1341 to determine its applicability in the Pennzoil situation.

The first court ruled in favor of Pennzoil, the Taxpayer, and permitted the deduction and the Mitigation treatment of Code Section 1341. However, the Appellate Court eventually found in favor of the I.R.S. and that Pennzoil could not use Code Section 1341.

Ultimately the higher court in Pennzoil decided that though Pennzoil may have met many of the requirements of Code Section 1341, it was not entitled to 1341 treatment. The discussion of the requirements by the two courts is invaluable.2/

The Pennzoil Courts both stated that the language of §1341 requires the Plaintiff to prove that five factors have been met: The emphasis supplied below was the Courts.

(1) an “item” must have been “included in gross income for a prior taxable year (or years)”;

(2) “because it appeared that the taxpayer had an unrestricted right to such item”;

(3) a “deduction” must be “allowable for the taxable year” in which the item is repaid;

As will be discussed, a divided Appellate Court’s with one dissent believed the main reason for denying Pennzoil the benefits of the Mitigation section was under a different exception to the Mitigation provision.

(4) “because it was established after the close of such prior taxable year (or years) that the taxpayer did not have an unrestricted right to such item or to a portion of such item”; and

(5) “the amount of such deduction” must exceed $3,000.

These requirements seem to be relatively straight forward and certainly there can be no question about the interpretation of the fifth requirement. However, several of these requirements are not as straight forward as they look. Each has to be understood within the tax world, where often there are exceptions to make sure special provisions, like the Mitigation provision, applies only to those that are legally deserving of them.

The fact that two very learned courts, the Court of Claims (the “Lower Court”) and the Court of Appeals (the “Appellate Court”) differed on whether the requirement of an “item” of income has been met, shows how technical this section is. This is in order to insure that only a certain category of Taxpayer receives this Mitigation.

1. THE FIRST REQUIREMENT FOR MITIGATION IS THAT AN “ITEM” MUST HAVE BEEN INCLUDED IN GROSS INCOME FOR A PRIOR TAXABLE YEAR (OR YEARS)

Both Courts in Pennzoil addressed this two part question, first by determining whether the Taxpayer possessed an “item”, and next whether that item was “included in gross income.” I.R.C. § 1341.

Guidance as to what is an “item” of gross income is found in the I.R.S. Code Section 61. That Code Section provides a specific definition for gross income and a general one. Another Code Section, Section 161, provides an allowance for deductions that are also specifically listed in the Code. The income “items” that might be included in income in a Ponzi Scheme might include any of the following found in Code Section 61.

Except as otherwise provided . . . . gross income means all income from whatever source derived, including (but not limited to) the following items:

- Gross income derived from business;

- gains derived from dealings in property;

- interest;

- rents;

- royalties;

- dividends;

- annuities;

- income from life insurance and endowment contracts;

- pensions;

- income from discharge of indebtedness;

- distributive share of partnership gross income;

- income in respect of a decedent; and

- income from an interest in an estate or trust.

It seems that there may actually be different tax treatments insofar as the Mitigation provision is concerned. The “profits” that create the false Income in some Ponzi Schemes could very well be excluded from the Mitigation problem because they are a result of phony “inventory sales”. However, it is generally going to be more likely that “phantom income” (income that never really existed) will consist of interest, dividends or many of the other items listed as income in the Code Section.

The issue of whether a clawback payment represents an “item” of gross income for purposes of Mitigation goes a step further than simply qualifying under Code Section 61. In addition, the courts will review the “item” to determine whether the item resulted from the same circumstances as those of the original inclusion. This is known as the “same circumstances” test.

The Lower Court in the Pennzoil case found that the requirement that the Taxpayer’s $4.4 Million obligation to repay suppliers as a result of Pennzoil’s alleged price fixing was from the same circumstances as the original inclusion of funds.

However, the Appellate Court reversed the Lower Court and differed as to whether Pennzoil’s refund met the same circumstances test. The Court defined the test as follows:

“The claim of right” interpretation of the tax laws has long been used to give finality to [the annual accounting] period, and is . . . deeply rooted in the federal tax system” Section 1341 is an exception to the claim of right doctrine. The “same circumstances” test, formulated by the Tax Court, “provides appropriate, workable limits” to that exception. The limitations are that “the requisite lack of an unrestricted right to an income item permitting deduction must arise out of the circumstances, terms and conditions of the original payment of such item to the taxpayer.”

Several examples were shown of this principle. In the Bailey case, the taxpayer received dividends, salary, and bonuses as the officer of a corporation, and later paid a civil penalty for violating an FTC order in the work he did for the company. The taxpayer claimed that his payment of the penalty restored an item of income included in his gross income in previous years. The Court then invoked the “same circumstances” test to deny 1341relief, reasoning that the FTC penalty “arose from the fact that Bailey violated the consent order, and not from the circumstances, terms and conditions of his original receipt of salary and dividend payments: and that “the amount of the penalty was not computed with reference to the amount of his salary, dividends and bonuses, and bears no relationship to those amounts.”

In other examples it was shown that the Court barred application of § 1341 where the item included in income (medical fees from Blue Cross) “did not arise out of the same circumstances, terms and conditions” as taxpayer’s restitution payment for fraud to Blue Cross. The Court denied Mitigation relief where corporation’s revenues in prior taxable years “bore no relationship to the amount of the obligation to pay for environmental clean-up” in later years and the court denied the Mitigation provisions to a taxpayer’s settlement of claims for negligence and breach of fiduciary duty arising out of her business because they had “no connection” to consulting fees she received after selling the business.

In short, where the later payment arises from a different commercial relationship or legal obligation, and thus is not a counterpart or complement of the item of income originally received, the “same circumstances” test preludes application of § 1341.

It would seem that the “same circumstances” test is generally going to be satisfied on the very face of the Ponzi clawback transaction. Had it not been for the Ponzi Scheme Investment, there would be no tax on or reporting of income transactions that would comprise a clawback.

All income in a Ponzi Scheme is reported as a direct result of the Scheme. The clawback obligation is a direct result of that scheme and the payment from the scheme.

As a practical matter, any Settlement agreement that is being reached in a Ponzi Scheme should include language to clarify the “item” being refunded. For that matter, any settlement agreement including a clawback should be reviewed by tax counsel prior to finalization.

Included in Gross Income

The second part of the first requirement for Mitigation is that the “item” must have been included in gross income for a prior taxable year. This in fact means included in gross income and subject to taxation in that prior years. This is typically not controversial in the case of a Ponzi Scheme as the income from the scheme, whether actual or phantom, will have been reflected in the tax returns.

2. it Appeared that the Taxpayer had an Unrestricted Right to Such Item.

The next item requires that the Taxpayer had an apparent right to the gross income that the taxpayer reported in the prior year. For quite a while prior to the Pennzoil case, there were differences of opinion that separated this requirement into three different areas. Did the taxpayer have an “apparent right”, did the taxpayer have an “actual right” or did the taxpayer have “no right” at all?

As to the first two of these items, some courts embraced a distinction between an actual right and an apparent right, while others found that an “apparent right” encompassed an “actual right”. The Lower Court in Pennzoil found this distinction to be meaningless. The rationale was not challenged by the Pennzoil Appellate Court.

The Pennzoil lower court found that the Mitigation statute was ambiguous in defining an “apparent right” to the included income. There was no binding case law regarding the actual and apparent dichotomy. The Court therefore turned to the legislative history of § 1341. The legislative history does provide guidance as to the meaning of the term “apparent” in § 1341. In the House and Senate Committee Reports, the legislature states that § 1341 will apply “[if] the taxpayer included an item in gross income in one taxable year, and in a subsequent taxable year he becomes entitled to a deduction because the item or a portion there is no longer subject to his unrestricted use.” Pennzoil held that due to this, an actual right must be included in the definition of an apparent right for purposes of § 1341.

Though the Pennzoil Court of Claims case was reversed, it was not reversed as to this finding and the Court’s analysis is still very helpful.

This reasoning of the Court is important here because the Court stresses that since the Mitigation Provision is remedial it should be interpreted in favor of the Taxpayer. Therefore, § 1341 should be interpreted broadly to effectuate congressional goals. Any doubts regarding the plain meaning of the statute must be resolved against the government and in favor of the taxpayer.

Section § 1341 is a relief provision . . . This would encourage taxpayers to return funds they may have received in appropriately by neutralizing all negative tax impacts of the prior taxation. It should be remembered that Section 1341 is not a tax deduction provision. It does not grant taxpayers a tax benefit for amounts that are not otherwise deductible.

Pennzoil may even stand for the proposition that when a taxpayer reports an “item” as taxable income in a tax return; a prima facie case is made that the taxpayer believed the income was the Taxpayer’s. As the court in Pennzoil put it:

Since Quaker State took into income the [item] it is clear that Quaker State believed that it had a right to that income”.

Certainly in the case of the Ponzi Scheme every objective indication is that there is an apparent right to income that is being reported by that investor. It is stated on the investor’s tax return, available for distribution to them until the crash comes and as can be seen by the many lives devastated by Madoff and others, counted on by the Ponzi investor as real.

The Claim of Wrong Exception

To be entitled to the Mitigation, a Taxpayer must not have only had an apparent right to the reported income; the Taxpayer must have not wrongfully obtained that income.

Intertwined in this issue of an “apparent right” to the income is a doctrine known as the claim of wrong exception. This means that if the Taxpayer had no right at all to the income when it was received, it could not receive Mitigation treatment if later that income was refunded. It is often raised by the I.R.S. to deny the Mitigation section.

Like the “same circumstances” doctrine, the claim of wrong doctrine originates in the case law arising out of the claim of right deduction. The I.R.S. position is that a taxpayer cannot have any right to income for purposes of Code Section 1341, even an “apparent” right to income, if the original claim of the income was “wrongfully obtained. This doctrine has been applied in cases of embezzlement, smuggling, kickbacks and ill gotten gains and rarely in a civil fraud setting.

One thing that is clear about the “claim of wrong doctrine”; is that the doctrine cannot exist in a situation where there is no intentional wrongdoing. It certainly does not exist in the typical Ponzi Scheme victim Taxpayer where lending or investing money with a highly respected and presumably trustworthy and wealthy member of the community (who turned out to be a con man) cost the Taxpayer financial loss and sometimes even their life’s fortunes.

The Court in Pennzoil explained the claim of wrong in this fashion:

. . . [I.R.S.] argues that [Taxpayer’s] alleged price-fixing means that it could not have believed [the Taxpayer] had an unrestricted right to the income it earned between 1981 and 1995. [This] position is buttressed by the Federal Circuit’s decision in Culley, in which the court held that a plaintiff could not have believed that he had an unrestricted right to income, since the income was gained through an intentional wrongdoing. [Pennzoil] has been neither indicted nor convicted, and [Pennzoil] asserts that it “believed at the time it made the payments to the independent oil producers that it paid them a fair and honorable sum.” In fact, in the antitrust settlement, [Pennzoil] did not even admit liability.

The Taxpayer who is subject to a clawback in the typical Ponzi Scheme is much more pristine than Pennzoil. The Taxpayers who invest money are paid interest or other types of income for their loans or investments, receive their funds, pay tax on them and have given it all back through no fault of their own.

3. THE THIRD REQUIREMENT FOR MITIGATION IS THAT A DEDUCTION MUST BE ALLOWABLE FOR THE TAXABLE YEAR IN WHICH THE ITEM IS REPAID

The third requirement is that in the actual year of payment that the Taxpayer pays the clawback, the payment must be a permitted deduction that is allowable for the taxable year in which the repayment is made. Simply put, it means that a clawback paid in the year 2011, for example, must be allowed as a deduction for that payment in the year 2011. If the payment presents Ponzi profits paid to a Taxpayer and reported for tax purposes in 2006 it will not be allowed to be deducted at the rates applicable for 2006 unless a deduction is permitted in 2011, the payment year.

Whether a loss from a Ponzi Scheme is deductible is a question already decided in the affirmative by the Internal Revenue Service. In the year 2009, the I.R.S., in response to all of the pending claims for refund generated by the Madoff situation, produced two public documents; Rev. Procedure and Rev. Ruling. Those documents make it clear that victims of a Ponzi Scheme are entitled to a deduction for their loss relating to that Ponzi Scheme. The Ponzi Scheme which is ultimately responsible for a clawback is the same Ponzi Scheme that caused any of the other losses.

This is the law since the I.R.S. has found that a Ponzi Scheme is a transaction entered into for profit. There is no question that the Taxpayer’s investment in a Ponzi Scheme is an investment entered into for profit. Revenue Ruling 2009-9 makes it clear that Code Section 165 (c)(2) applies to Ponzi Schemes as transactions entered into for profit. A deduction for a theft loss would be available in 2011. The clawback payment should not be any different.

The Deduction - The Safe Harbor – The Waiver Of The Mitigation Provisions?

The Revenue Procedure that the I.R.S. issued in 2009 outlined an easy administrative procedure to obtain deductions resulting from a Ponzi Scheme loss. A Taxpayer may find that he or she wishes to use the Safe Harbor and may also be subject to a Clawback. A Taxpayer should not use the Revenue Procedure if they are expecting a clawback without professional advice.

The Safe Harbor requires the Taxpayer to waive the right to use Code Section 1341. The question is whether the waiver of Code Section 1341 is a waiver only of that right to use 1341 on a direct Ponzi theft loss, or is it a waiver of the right to use Code Section 1341 for Clawback payment in that year also?

It is not settled whether this waiver in the Safe Harbor applies only to Ponzi Scheme loss claims or also to clawbacks in general. The IRS Revenue Ruling 2009-9, which legally justifies a theft loss deduction for Ponzi Schemes in the year of discovery, also addresses the use of Code Section 1341 by Ponzi Scheme victims applying for a direct theft loss deduction on their Ponzi Scheme losses. The Revenue Ruling says that the Code Section 1341situation does not apply. However, that Revenue Ruling implies that a “Clawback” may very well be distinguishable from a direct theft loss and may not be prohibited by the waiver of Code Section 1341that is required by the Safe Harbor. This is because there is no “restoration of funds” in a Ponzi Scheme loss. Whereas; in a Clawback just such a restoration of funds does exist.

To satisfy the requirements of § 1341 . . . a deduction must arise because the taxpayer is under an obligation to restore the income.

When A incurs a loss from criminal fraud or embezzlement by B in a transaction entered into for profit, any theft loss deduction to which A may be entitled does not arise from an obligation on A’s part to restore income. Therefore, A is not entitled to the tax benefits of § 1341 with regard to A’s theft loss deduction.

This is an accurate statement of the law on Ponzi losses. However, Revenue Ruling 2009-9, in denying that Code Section 1341 would apply to “theft losses” from Ponzi Schemes, did not consider theft losses that result from payments from “Clawbacks”.

These are the same type of losses and they are directly related to the fact that the Ponzi Scheme investor invested in a fraudulent scheme.

In fact the Revenue Ruling seems to confirm that Code Section 1341 would apply to clawbacks since all that was missing according to the Revenue Ruling was an “obligation to restore”. This is exactly what is present in a Clawback, the restoration of funds. The Revenue Ruling only considered direct losses from Ponzi Schemes where no additional payments were required. That is not that Taxpayer’s case in a Ponzi Scheme clawback.

In a clawback situation, the losses come after the Ponzi Scheme has failed and they are a result of a forced repayment, not an original payment.

4. THE FOURTH REQUIREMENT FOR MITIGATION TREATMENT IS THAT THE FUNDS MUST BE RESTORED “BECAUSE IT WAS ESTABLISHED AFTER THE CLOSE OF SUCH PRIOR TAXABLE YEAR (OR YEARS) THAT THE TAXPAYER DID NOT HAVE AN UNRESTRICTED RIGHT TO SUCH ITEM OR TO A PORTION OF SUCH ITEM”

In the fourth requirement the Statute requires that when the Taxpayer refunded the clawback monies, it must be clear that the Taxpayer did not voluntarily return funds in order to profit from the Mitigation provisions.

There was a good deal of litigation on just what was meant by the “established” requirement. This also was clarified in the Low Court in the Pennzoil case. The bottom line is that funds cannot be “voluntarily repaid” and the best proof of this can be a good faith settlement agreement reached with the clawback trustee.

The fourth requirement of Section 1341 is that income is restored to another person because it was established after the close of such prior taxable year (or years) that the taxpayer did not have an unrestricted right to such item (or portion thereof)”.

Pennzoil states that the “established” requirement is met under the following circumstances:

. . . The general rule is that a good faith, non collusive settlement agreement entered into to terminate litigation will “establish” a liability to return income, thereby establishing a lack of an unrestricted right to income for purposes of Section 1341.

The Pennzoil case analyzed the two landmark cases deciding this issue and the standard to meet the “established” requirement. The Pennzoil case analyzed both the Barrett case and the Pike case that some courts had indicated were in contradiction. However, Pennzoil pointed out there was no contradiction. In doing so, Pennzoil clarified another “doctrine” that has developed in the Mitigation provision. The doctrine of “voluntary payment”.

The Pennzoil case clarified that doctrine in this area of law also and in so doing makes it perfectly clear that the Taxpayer’s good faith efforts in the Ponzi Scheme to resist repayments of money in this fraud should meet the “established” requirement of the law.

In Barrett, the taxpayer had included profit from the sale of stock options in one year, and then in a later year, the Securities and Exchange Commission brought administrative proceedings against him on the basis of alleged insider trading. The taxpayer settled the case without admitting liability and claimed that the settlement payment deserved § 1341 treatment. Barrett held that a settlement made at arm’s length and in good faith can satisfy the “establishment” requirement of § 1341, stating:

“The source of the obligation [to repay] need not be a court judgment; however, there must be a clear showing . . . of the taxpayer’s liability to repay.”

Barrett also noted that this result “fostered the legal policy of peaceful settlement of disputes without litigation.

In contrast to Barrett was the Pike case that involved a taxpayer who bought and sold corporate stock in one year, after which an investigator found that the profit from said stock should have gone to the corporation and not the taxpayer. The taxpayer then paid the money to the corporation, without admitting that the profits belonged to the corporation, and avoiding controversy so that he did not suffer harm to his professional career. The Pike court stated that, although “a judicial determination of liability is not required … it is necessary under section 1341 for a taxpayer to demonstrate at least the probable validity of the adverse claim to the funds repaid.”

Although the holdings in Pike and Barrett are different due to distinguishable facts, the point of law that they stand for was not. The primary distinction is that, in Pike, there was no suit against the plaintiff for repayment of money, which makes it more likely that the taxpayer acted voluntarily in paying the money and less likely that the taxpayer can “demonstrate at least the probably [sic] validity of the adverse claim.” Voluntary restitution will not meet the establishment requirements.

In Barrett, (1) an actual settlement was made with the plaintiff(s) who had filed suit; (2) the taxpayer denied liability when entering into the settlement; and (3) there was no indication that either settlement was not made at arm’s length. Under these circumstances, the Taxpayer has met the establishment test. This is going to be the typical scenario in a clawback situation.

Private Letter Ruling 200808019, though not authority, is an excellent statement of the law on this issue. It also establishes standards that were all met in the Taxpayer’s case.

- - -

Footnotes:

1/ The Mitigation does not seem applicable to a clawback of a principal payment invested in a Ponzi Scheme, since the principal payment does not represent the Taxpayer’s “income” from the Ponzi Scheme. This article focuses only on the clawback of “income items” reported by a Taxpayer that arises from a Ponzi Scheme.

2/ The two Pennzoil cases were ultimately decided on two principles, one of which was the “inventory exception”. There is an exception in Code Section 1341 that does not permit that section to apply to refunds of items related to “inventory income”. This is because the income tax treatment of “inventory items” have their own tax framework to allow for corrections. That overpriced oil sold by Pennzoil was inventory. All of the Appellate Court Judges agreed that the repayment by Pennzoil was a cost to Pennzoil that would be reflected in its inventory accounting.

Download this article as a .pdf

DO YOU HAVE ADDITIONAL QUESTIONS - CONTACT RICHARD S. LEHMAN TODAY! :

This PRE IMMIGRATION online seminar is available to help non-resident aliens understand their options in dealing with United States tax issues. You may jump directly to more detail about this free seminar by clicking here.

NEW U.S. TAX LAW Seminar Series: 5.5 hours FREE Continuing Education Course Credits

These seminars cover a complete range of topics dealing with legal and practical advice for foreign investors that invest in United States businesses, United States real estate and United States securities; and aliens that immigrate to the United States. This includes income, estate and gift tax planning for nonresident alien individuals and foreign entities such as foreign corporations, foreign trusts and foreign partnerships. Special sections are devoted to foreign investors in United States Real Estate, Tax Planning and Pre Immigration Tax Planning.

Also included in this group of seminars is a thorough study of the United States tax laws governing the tax deductions and tax refunds available for victims of Ponzi Schemes and other theft losses under the Internal Revenue Code Section 165. www.ustaxlawseminars.com

WATCH A SHORT OVERVIEW OF SEMINAR FORMAT:

Introduction

The “Offer in Compromise” is the typical way for Americans to resolve outstanding tax liabilities that they are unable to meet.1

It is a reasonably fair process with levels of Taxpayer protections. However, it is not as is often advertised, a procedure that produces the miracle of reducing $50,000 in tax liability to $5,000 without extraordinary circumstances. Right now, any Taxpayer that has the ability to meet a portion of their outstanding tax liabilities, if they have a breathing period of several years, should give an Offer in Compromise serious consideration. Offer in Compromise settlements are based upon the Taxpayer’s assets and overall financial situation. The worse the Taxpayer’s financial situation looks, the better the settlement with the I.R.S. The bad economy is one reason why now is the time to consider an Offer in Compromise.

Offers in Compromise

The IRS has the authority to accept less than full payment and to compromise a taxpayer’s tax liabilities if it is unlikely that the IRS can collect the tax liability in full.

The basis for a settlement for less than the full amount of the liabilities by the I.R.S. must be either

(1) There is a dispute as to the amount that the taxpayer owes (Doubt as to Liability);

(2) There is doubt that the liability can be collected in full. (Doubt as to collectability); or

(3) If a settlement of a tax liability will promote effective tax administration.

Doubt as to Collectability

The IRS will accept an offer in compromise if it achieves the collection of an amount that is potentially collectible at the earliest possible time and at the least cost to the government. In order to accomplish the goal, the Internal Revenue Code provides the offer in compromise as the exclusive method for compromising all taxes, penalties, and interest for the periods and taxes covered by the offer.

An offer is legally sufficient to be accepted due to doubt as to collectability of the full tax liability if it closely approximates the amount that the IRS could reasonably collect by other means, including through an administrative or judicial proceeding. The I.R.S. will consider four components in determining doubt of collectability (i) net equity in assets, (ii) present and future income, (iii) amounts collectible from third parties, and (iv) amounts that the taxpayer should reasonably be expected to raise from assets available to the taxpayer but beyond the reach of the IRS.

In calculating the maximum collectible amount from a taxpayer, the IRS determines if the taxpayer’s assets and present and future income are less than the full amount of the assessed liability. In determining ability to pay, the IRS permits taxpayers to retain sufficient funds to pay basic living expenses. Basic living expenses are based upon an evaluation of the individual facts and circumstances of each case, taking into account published guidelines on national and local living expenses standards.

Effective Tax Administration

If there are no grounds for compromise based on doubt as to liability or doubt as to collectability, the IRS may accept an Offer to Compromise to promote effective tax administration. Generally, this means that the I.R.S. will settle for a compromised tax liability if the collection of the full liability is possible, but will create economic hardship.

The following are examples of this category:

Economic Hardship: Long-term Illness

- Taxpayer has assets sufficient to satisfy the tax liability. The Taxpayer provides full time care and assistance to her dependent child, who has a serious long-term illness. It is expected that the Taxpayer will need to use the equity of her assets to provide for adequate basic living expenses and medical care for her child. The Taxpayer’s overall compliance history does not weigh against compromise.

Economic Hardship: Liquidation of Assets

- The Taxpayer is retired and his only income is from a pension. His only asset is a retirement account and the funds in the account are sufficient to satisfy the liability. However, the liquidation of the retirement account would leave the Taxpayer without an adequate means to provide for basic living expenses. His overall compliance history does not weigh against compromise.

The Proposal to Compromise

The Form 656 is the starting point for an offer in compromise. The taxpayer must indicate the facts and reasons why the IRs should accept the offer and which of the three categories, (doubt as to liability, doubt as to collectability, or effective tax administration); apply to the Taxpayer’s situation.

A Taxpayer seeking to compromise a liability based on doubt as to collectability or effective tax administration must also submit a Form 433-A (Financial Statement for Individuals) and any other financial statement prepared by the Taxpayer signed under a penalty of perjury.

Taxpayers that submit an offer to compromise individual income tax liabilities and who also have substantial business interests may also be required to submit a Form 433-B for the business.

The taxpayer may make a cash offer or a deferred payment offer.

The taxpayer is responsible for initiating the first specific proposal for compromise. A taxpayer must make partial payments to the IRS while the taxpayer’s offer is being considered. For lump sum offers, taxpayers must make a down payment of 20% of the offer with the application. For these purposes, a lump sum offer includes single payments as well as payment made in five or fewer installments. If the taxpayer proposes to pay in installments, the first installment must accompany the offer, and the taxpayer must comply with the proposed payment schedule while the offer is being considered (or the IRS will consider the offer withdrawn).

Application Process

The Taxpayer wants to make sure the offer is in an acceptable form or it will be rejected if it cannot be processed. In such instances, the IRS will contact the taxpayer to indicate and request the information that is missing or needs to be corrected.

Some items to double check before an offer in compromise is submitted are:

- The taxpayer must identify the tax liabilities and years to be compromised;

- The taxpayer must make a financial offer; and the

- Payment terms must be specified;

- The pre-printed terms of the Form 656 must not be altered and it must fully disclose assets and liabilities owed jointly and owned individually;

- The taxpayer’s taxpayer identification number must be correctly stated;

- The offer must be signed;

- Necessary financial statements – Form 433-A and/or 433-B – must be completed and signed.

When the offer is submitted by a person who shares household expenses, disclosure of the non-liable individuals’ financial information can be required to determine the taxpayer’s share of the household expenses.

Collection Proceedings During Offer

Once the offer in compromise is received, the IRS will not automatically withhold collection activity. Generally, collection activity is suspended if the offer is not frivolous and if the tax liability that the taxpayer seeks to compromise is not in jeopardy.

The IRS will not make any levies to collect the liability that is the subject of the compromise during the period the IRS is evaluating whether such offer will be accepted or rejected, for 30 days immediately following the rejection of the offer, and for any period when a timely filed appeal from the rejection is being considered by Appeals.

The IRS directs the examining officer to determine processibilty of the offer as soon as possible, but within 14 days, and to then contact the taxpayer. If the IRS determines that the offer is processible but needs to be perfected, the IRS may communicate with the taxpayer by letter or by personal contact or request the additional information needed to perfect the pending offer. If the taxpayer does not respond timely, the IRS closes the offer as a return.