Tax Planning Techniques for the Foreign Real Estate Investor can be a complicated topic. Recently Richard S. Lehman presented an “advanced” course on this topic to a group from the Realtors Association of the Palm Beaches. The overwhelming consensus was…

Blog Archives

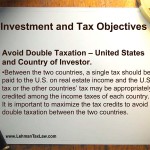

Meeting The International Client’s Needs

Tax Planning for Foreign Investors Acquiring Smaller ($500,000 and under) United States Real Estate Investments

. . .U.S. estate taxes may be completely avoided if the individual foreign investor owns a foreign corporation that may in turn own the U.S. real estate.

Tax Planning for Foreign Investors Acquiring Larger (One Million Dollars and over) United States Real Estate Investments

This is principally an article about tax planning for the non resident alien individual and foreign corporate investor that is planning for larger size investments in United States real estate (“Foreign Investor”). That is investments of One Million Dollars ($1,000,000)…

Tax Planning Techniques for the Foreign Real Estate Investor - Advanced

The History of the Real Estate Taxation

Until the mid 1980s Foreign Investors who were well advised never paid any U.S. federal income tax or capital gains tax. Until that time the U.S. had a treaty with the Netherlands Antilles by virtue of that country’s relationship with…