Did Taxpayers Pay A Tax They Did Not Owe?

Internal Revenue Code Section 965

Code Section 965 of the U.S. Internal Revenue Code (the “Code”) has been in the Code for many years in a completely different form. It was previously titled the “Temporary Dividends Received Deduction” and the section addressed only the deduction available to U.S., corporate shareholders that received dividends from “Controlled Foreign Corporations”.

The concept of Controlled Foreign Corporations has been in the Internal Revenue Code for many years. Essentially the concept of the Controlled Foreign Corporation is a corporation foreign to the United States that is owned in whole or in part by United States interests such as individual U.S. persons, U.S. corporations, U.S. partnerships and other U.S. entities.

The new version of Code Section 965, pursuant to the “Tax Cuts and Jobs Act” that was passed by the U.S. Congress in December of 2017 is dramatically different. Code Section 965 has been revised and now represents a new tax pursuant to which the United States can in essence force the repatriation of earnings and profits by U.S. owned Controlled Foreign Corporations that have accrued earnings and profits in foreign jurisdictions over the years, which have not been previously subject to Income taxes. The accumulated and deferred earnings and profits will now be taxed by the United States.

Under the new Code Section 965, previously untaxed foreign earnings and profits are now subject to taxation at reduced tax rates that in essence are, (for tax purposes only), a forced repatriation of earnings and profits of Controlled Foreign Corporations. These earnings and profits could have been accumulated and not been subject to taxes by the U.S. since 1986.

The most important part of this tax opinion is that this Code Section 965 only applies to U.S. Shareholders of a “Specified Foreign Corporation”. A U.S. Shareholder is a U.S. person (which includes a citizen or resident of the United States, a domestic partnership, a domestic corporation any estate and any U.S. trust) who owns or is considered as owning 10% or more of the total combined voting power of all classes of stock entitled to vote. A Specified Foreign Corporation means a (1) “Controlled Foreign Corporation” and (2) Any foreign corporation that has one or more U.S. corporations as a United States shareholder.

The first step is determining if a foreign corporation is indeed a Controlled Foreign Corporation. If it is not, the new tax imposed by Code Section 965 does not apply.

A Controlled Foreign Corporation is defined as follows:

The term “Controlled Foreign Corporation” means any foreign corporation if more than fifty percent (50%) of:

(1) The total combined voting power of all classes of stock of such corporation entitled to vote, or

(2) The total value of the stock of such corporation is owned or is considered as owned, by applying certain rules of ownership to United States shareholders, on any day during the taxable year of such corporation.

Internal Revenue Code Section 958(b) provides the rules for determining direct shareholder control and whether there is any indirect control of a corporation’s shares by virtue of the ownership of shares by closely related family members, (the “Attribution Rules”).

The issue is, when does a foreign corporation meet these standards? The answer can be misleading.

The Shares

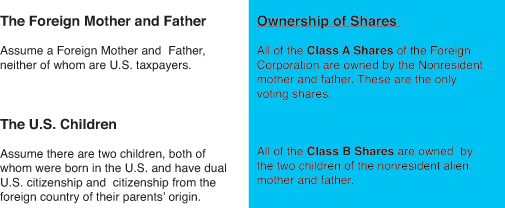

Assume the foreign corporation is owned by two separate groups of shareholders that own either Class A or Class B Shares.

The following shareholders own:

The Class A Shares and the Class B Shares have distinctively different rights.

The Class A Shares have one hundred percent (100% of the voting rights for decisions being made pursuant to the corporation’s general meeting.

The Class A Shares have one hundred percent (100% of the voting rights for decisions being made pursuant to the corporation’s general meeting.

The children’s Class B Shares have no voting rights and in the case of liquidation of the corporation, the parents, who have no formal connections to the United States have the power to determine that the equality in the corporation can be distributed as a dividend to the A shares only.

Assume, in addition, only the majority of the voting shares can decide the amount of annual dividends will be paid, if any, to the shareholders holding A Shares and/or B Shares.

Consequently, the owner of the A Shares with the sole voting rights to declare dividends is in the position to decide that the A Shares shall receive substantially more of, (or all of) the dividends that can at any time be distributed to the A-shareholder only.

As a practical matter, no dividends can be forced to be allocated and paid to the B shareholders and there is a Shareholder Agreement in place that provides that the B Shareholders have no formal rights in this matter.

Based on the fact that all of the A-shares in the Foreign Corporation are owned by the mother and father, they are in the position to make all the decisions in the general meeting.

CODE SECTION 965

The introduction in late December of 2017 of Code Section 965 to the American tax system has dramatically changed the law regarding American owned foreign corporations that are only partially owned by Americans.

This Code Section requires now that certain American owned foreign corporations must, for tax purposes, repatriate their accumulated foreign profits to the United States and over a period of time pay U.S. taxes on these profits.

The amounts of the foreign earnings and profits is measured under Code Section 965 as the greater of the -1986 deferred foreign income of a Controlled Foreign Corporation determined as of November 2, 2017 or December 31, 2017.

In essence, under new Code Section 965 all unreported accumulated earnings and profits from 1986 through the date of November 2, 2017 or December 31, 2017 will be subject to the new tax.

The Requirements of Code Section 965

Code Section 965 defines the income that will be taxed as the gross income of United States shareholders in certain foreign corporations known as “Deferred Foreign Income Corporations”. A “Deferred Foreign Income Corporation” is categorized as any foreign corporation that is a “Specified Foreign Corporation”.

For purposes of this discussion, a Specified Foreign Corporation means a (1) “Controlled Foreign Corporation” and (2) any foreign corporation that has one or more U.S. corporations as a United States shareholder.

A “Controlled Foreign Corporation” is defined as follows:

Any Foreign Corporation if more than 50% of the total voting power of classes of stock of such corporation entitled to vote or more than 50% of the total value of the stock of such corporation is owned . . . or is considered as owned . . . by United States shareholders on any day during the taxable year of such corporation.

There is substantial authority that in the case of the Foreign Corporation, such as the corporation in this example that the Foreign Corporation is not a Controlled Foreign Corporation and Code Section 965 is not applicable.

Voting Shares

It is clear in this case that the United States shareholders do not own any of the A Shares of the Corporation as a result of the “attribution rules”. The mother and father of the two children that are both U.S. citizens and citizens of their parents’ country of origin should not be attributed the A Shares from their parents. This is because the “Attribution Rules” under Code Section 318(a) will not apply to the children in this situation.

As a general rule, the shares of stock in a foreign corporation are subject to what is known as the “Attribution Rules”. This is a set of rules that treat certain family members who do not actually own shares in a foreign corporation to be considered as owners of a relative’s shares to determine whether a “related group of family members” is in control of the corporation.

In the matter of determining whether the “Attribution Rules affect this corporation, it is clear that no such “Attribution Rules” apply because stock owned by nonresident alien individuals shall not be considered as being owned by a citizen or by a resident alien individual. Here, since the parents are both nonresident aliens, their U.S. children will not be attributed ownership of the parents’ A Shares.

No Ownership of 50% of Voting Shares

Code Section 958 (Rules for Determining Stock Ownership) governs the rules that determine whether certain related parties are grouped as a whole for purposes of determining whether a corporation is a “Controlled Foreign Corporation”. Under certain circumstances, family members, such as a mother and her children, would generally be treated as if the ownership of the mother’s shares belonged to the children for ownership purposes and vice versa.

However, there is an exclusion when it comes to determining whether this situation applies to “Controlled Foreign Corporations” when any of the related parties are nonresident aliens.

That exclusion specifically states that there is no attribution of a mother and father and child’s shares to each other for the purpose of determining ownership of a Controlled Foreign Corporation, when any of the shareholders are nonresident aliens to the United States.

This portion of the law in Code Section 958(b)(1) that governs the relationships among related shareholders specifically states as follows:

“In applying [the attribution rules] stock owned by a nonresident alien individual, the [parents] . . . shall not be considered as owned by a citizen or by a resident alien individual” [the children].

Thus, the standard of determining whether a foreign corporation is a “Controlled Foreign Corporation” shows that the 100% of the voting stock of the parents of the two children is not attributable to the children to determine whether the corporation is a Controlled Foreign Corporation.

In determining whether U.S. Shareholders own the requisite percentage of total combined voting power of all classes of stock entitled to vote, consideration will be given to whether there could be “indirect control” under all of the facts and circumstances of each case. In all cases, however, United States shareholders of a foreign corporation will be deemed to own the requisite percentage of total combined voting power with respect to such corporation:

(i) if they have the power to elect, appoint, or replace a majority of that body of persons exercising, with respect to such corporation, the powers ordinarily exercised by the board of directors of a domestic corporation;

(ii) if any person or persons elected or designated by such shareholders have the power to elect exactly one-half of the members of such governing body of such foreign corporation, either to cast a vote deciding an evenly divided vote of such body or, for the duration of any deadlock which may arise, to exercise the powers ordinarily exercised by such governing body; or

(iii) if the powers which would ordinarily be exercised by the board of directors of a domestic corporation are exercised with respect to such foreign corporation by a person whom such shareholders have the power to elect, appoint, or replace.

In addition, the IRS may not respect the stock ownership structure if it deems it to be an “arrangement to shift formal voting power away from U.S. shareholders of a foreign corporation if any voting power is retained in reality by the children shareholders. The mere ownership of stock entitled to vote does not by itself mean that the shareholder owning such stock has the voting power of such stock for purposes of the Controlled Foreign Corporation rules. For example, if there is any agreement, whether express or implied, that the parent shareholders will exercise voting power normally processed by the children shareholders, then the nominal ownership of the voting power will be disregarded in determining which shareholders actually hold such voting power, and the determination will be made on the basis of such agreement.

No Ownership of 50% of Value of Shares

As stated, there is an alternative standard to determine whether a foreign corporation is not a Controlled Foreign Corporation even if the ownership of voting shares is owned by a majority of U.S. persons.

This second standard is the standard of whether the total value of the stock of shares owned by the U.S. person (the children) is equal to fifty percent 50%) of the value of such stock.

Under the law of the foreign country in this case, as a result of both the law and the Shareholders Agreement between the family members, in principle, the children’s nonresident parents have the power “to determine that the equity in the company can be distributed as a dividend [to the] mother’s and father’s shares only”. In principle according to the Shareholder Agreement, the nonresident alien parents can determine that 100% of the dividends shall be distributed to the A-Shareholder only and zero to the B-Shareholders.

Since the U.S. children are not attributing their parent’s shares; the foreign corporation should not be considered a Specified Foreign Corporation and therefore it is not a Deferred Foreign Income Corporation. The children do not own 50% of the value of the corporation.

In this case, there is substantial authority that the foreign corporation is not a Deferred Foreign Income Corporation under Code Section 965 and therefore the corporation is not subject to the tax incurred by Code Section 965. Neither the ownership or value tests have been met.

There is substantial authority that code section 965 has no application or consequences to the children and code section 965 should not be applicable to the foreign corporation. As such, there is no reporting of taxes to pay that is required by the U.S. citizen children.

It is very important that those taxpayers who have similar situations double check their status before paying taxes under Code Section 965.